Statutory inheritance share refers to the approximate percentage of inherited property that the heirs would acquire under the law if the decedent did not leave a will. Under the Japanese Civil Code, legal heirs, including spouses, children, parents, and brothers and sisters, have the right to inherit property in the proportions determined for them. The statutory inheritance shares are intended to ensure equitable distribution among heirs and serve as the basic rule for inheritance procedures, although in some cases, different distributions may be made by wills or estate division agreements.

This column explains the "legal portion of inheritance" stipulated in the Civil Code with specific examples, and discusses various inheritance provisions stipulated in the Civil Code, such as the "portion left to the heirs".

When preparing a will, you should be aware of the following provisions to ensure that it is legally valid and prevents disputes.

This article is intended to provide an introduction to the general basics of inheritance tax.

Consult a tax attorney for individualized and specific inheritance tax advice and calculations.

What is legal inheritance?

civil code

(Statutory inheritance)

Article 900 (2) If there are several heirs of equal rank, their shares of inheritance shall be as follows

(i) If a child and a spouse are heirs, the share of inheritance of the child and the share of inheritance of the spouse shall be one half each.

(ii) If the spouse and lineal descendants are heirs, the inheritance share of the spouse shall be two thirds, and that of the lineal descendants shall be one third.

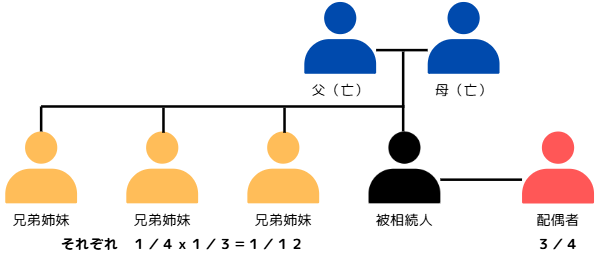

(iii) When a spouse and brothers and sisters are heirs, the share of inheritance of the spouse shall be three-fourths and that of the brothers and sisters shall be one-fourth.

(iv) If there are several children, lineal descendants or brothers and sisters, their shares of inheritance shall be equal. However, the share of inheritance of brothers and sisters who share only one parent shall be one half of that of brothers and sisters who share both parents.

What is "statutory inheritance."The "standard" percentage of inheritance based on the division of inherited property as stipulated by the Civil Code.means a person who has been a member of the board of directors of the Company for a certain period of time.

Statutory inheritance shares shall take precedence over the following division of the estate due to individual circumstances, if any.

- Designation of the portion of inheritance by will

- Designation of the portion of inheritance by a third party as set forth in the will

- Ratio of division by agreement on the division of the estate among the joint heirs

The order and proportion of inheritance established by the Civil Code

If there is a superior heir, the subordinate heirs have no inheritance rights.

The spouse is always an heir.

The "Inheritance Percentage" isIt depends on who the lower-level heirs are.

- If there are no other legal heirs: 1/1 (100%)

- If there is a child/grandchild of the first rank: 1/2

- If there is no first priority and there are parents of the second priority: 2/3

- If there is no first or second priority and there is a third priority sibling: 3/4

The term "spouse" refers to a person who is legally married and does not include a person who is in a common-law relationship.

The child is the heir of the first rank.

If the decedent has a spouse, he/she inherits 1/2, and if the decedent has more than one child, the 1/2 is divided equally.

If the decedent has no spouse (e.g., if the decedent died first), the children (or grandchildren) inherit the entire inheritance.

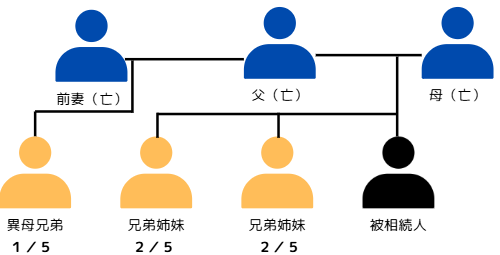

If there are several children, all children inherit in the same order and are equally divided by the number of children, regardless of sex, birth order, whether they are biological or adopted children, children of a first wife or a second wife, and whether they are legitimate or illegitimate children.

In the case of an ordinary adoptee, the adopted child also has inheritance rights with respect to the birth parents, so the adopted child has inheritance rights with respect to both the birth parents and the adoptive parents. However, in the case of a special adoptee, the blood relationship with the birth parents is severed, so the adopted child has no inheritance rights with respect to the birth parents.

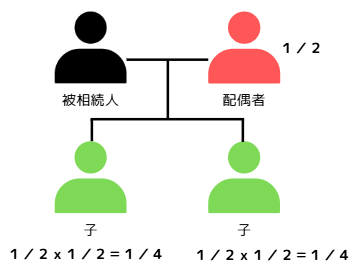

(Example) If the heirs are a spouse and two children

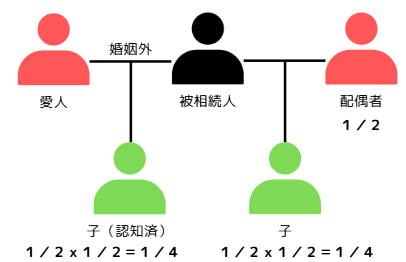

A "legitimate child" is legally defined as a child born to a legitimate wife or a legally recognized spouse. On the other hand, a "illegitimate child" is a child born to a man and a woman who are not related by marriage. In the past, a legitimate child had legal priority over a illegitimate child.Both legitimate and illegitimate children have the same inheritance rights.

In the case of a woman, the issue of recognition does not arise due to the fact that she has given birth, but a man cannot become her heir without recognition.

Article 779 of the Civil Code states that "a child born out of wedlock may be acknowledged by his/her father or mother" (voluntary recognition), while Article 787 of the Civil Code states that "the child, his/her lineal descendants, or their legal representatives may file an action for recognition" (compulsory recognition). Acknowledgment is usually made by submitting a "notice of recognition" to the municipal office, but it is also possible to acknowledge by will.

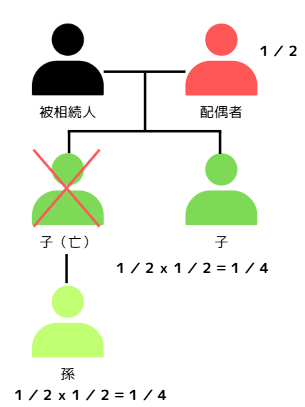

If a child is an heir and the child predeceased the decedent (the deceased) before the decedent's death, the child of that person (the grandchild of the decedent) is entitled to inherit. This is known as "inheritance by descent.

Furthermore, if the grandchild also died before the grandchild, the grandchild's child (the decedent's great-grandson) becomes the heir. This is called "reassumption of inheritance.

For example, if a grandchild is an heir by descent, even if the child is deceased, the grandchild is the heir of the first rank, and the heirs of the second and subsequent ranks have no inheritance rights.

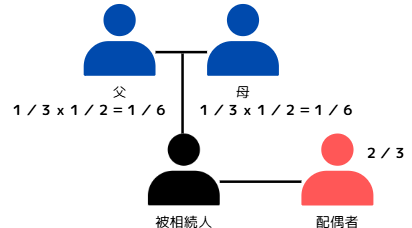

Only if there are no children/grandchildren of the first rankThe decedent's parents, who are second in line, are the heirs.

If the decedent has a spouseParents have 1/3 inheritance rights andIf the decedent has no spouse (e.g., if the decedent is unmarried or if the spouse died before the decedent), the entire inheritance is inherited by the parents.

If the parents have the right to inherit, their share of the inheritance is divided equally. If either parent is entitled to inherit, the grandparents are not entitled to inherit,There is no succession by descent.

(Example) If the heirs are spouse, father and mother

Only if there are no children/grandchildren of the first order or parents/grandparents of the second order,Siblings, who are third in line, are the heirs.

If the decedent has a spouse, he/she is entitled to 1/4 of the inheritance, and if the decedent does not have a spouse (e.g., if the decedent is unmarried or the spouse died before the decedent), the siblings (or nephews/nieces) will inherit the entire inheritance.

In the case of multiple siblings with inheritance rights, their inheritance shares are divided equally.

(Example) If the heirs are a spouse, an elder brother, a younger brother, and a younger sister

If a child or parent is the heir and the child or parent dies first, the grandchild or grandparent becomes the heir by descent, and if the grandchild or grandparent also dies first, the great-grandchild or great-grandparent "re-ascends," as previously mentioned.

However, if brothers and sisters become heirs and the brothers and sisters have died first, their children, nephews and nieces, become heirs. (Succession by descent) However,In the case of siblings, there is no "recusancy". In other words, the children of nephews and nieces (and nephews and nieces) do not become heirs.

When brothers and sisters are heirs, both brothers and sisters who share the same father and mother with the decedent (full blood brothers and sisters) and brothers and sisters who were born to a different mother (or father) and the decedent, that is, who share only father or mother (half-blood brothers and sisters), are heirs, but the half-blood siblings' The legal share of inheritance for half-blood siblings is one half of that of full-blood siblings.

Various other provisions for inheritance

In addition to the above provisions regarding legal heirs and the legal portion of inheritance, the Japanese Civil Code has detailed provisions regarding inheritance, such as the validity of wills, which are used for inheritance. The following is an explanation of the provisions of the Civil Code relating to inheritance.

Effect of the Will

A will is the last message from the deceased. If there is a legally valid will, inheritance will take place in accordance with the contents of the will, superseding the statutory inheritance shares stipulated in the above-mentioned Civil Code.

A will may specify the following items

- Designation of inheritance share

- Designation of method of division of property

- Prohibition on partition of the estate (but only for a period not exceeding five years from the time of commencement of inheritance)

- Order of the bearer on the claim for the amount of disgorgement

- Designation of executor

- Designation of Guardian or Supervisor of Guardian of Minor

- Designation of Mutual Security Liability of Heirs

simple and limited approval

Heirs shall inherit from the time they learn of the commencement of inheritance (generally, from the date they learn of death) to theWithin three months, the applicant must choose between "simple approval," "limited approval," or "waiver of inheritance.

simple approval

Simple approval means that the effects of inheritance areUnlimited and unconditional attribution to heirs.means a person who has been a member of the board of directors of the Company for a certain period of time.

No matter how much debt or other negative assets you have, you must inherit these. Simplified approval can be granted in the following casesIt is deemed to be a simple approval without any formalities.Therefore, caution should be exercised.

- Disposal of part or all of the inherited property before choosing the method of inheritance

- When the deliberation period (3 months) has elapsed

- Concealing or consuming part or all of the inherited property after choosing the method of inheritance, or failing to include it in the inventory of property to be submitted for limited approval

limited approval

What is limited approval?Repay inherited debts (debts, etc.) to the extent of inherited assets (positive assets) inherited from the decedent.Method of inheritance.

'I have property to inherit, but I don't know how much debt I owe.'

I'm worried about how much liability I'll have to guarantee in the future because the decedent was a guarantor for more than one person."

This limited approval is considered in cases such as the following.

The following procedures must be followed if you wish to obtain limited approval.

- Prepare an inventory of inherited property

- Submit an inventory of property to the family court within the deliberation period (3 months)

- All heirs" make a request to the family court for limited approval.

In addition,Limited approval requires the consent of all heirs and cannot be done by only some heirs,Once the limited approval is accepted, it cannot be revoked even during the deliberation period.

inheritance waiver

Disinheritance is the renunciation of inherited property.Declaration of intention not to inherit any positive or negative assetsand renounces the inheritance, he/she is considered not to have been an heir from the beginning under the Civil Code. It has the following characteristics

- Unlike disqualification or disqualification, there is no inheritance by succession.. Therefore, if a person renounces inheritance, his or her children cannot inherit by succession.

- Unlike limited approval, this can be done by one of the heirs alone.

- This is done by filing a petition with the family court within the deliberation period (3 months).

- Once the renunciation of inheritance has been accepted, it cannot be revoked even during the pendency period.

- Renunciation of inheritance cannot be made prior to the commencement of inheritance. This is to prevent the heirs from taking advantage of the weakness of others who will become heirs, or to intimidate heirs into renouncing their inheritance in advance.

Special Benefit, Contribution, and Special Contribution System

The Civil Code makes two modifications to the principle of "dividing the present property according to the legal share of inheritance" to ensure that the estate is divided substantially equitably among each co-heir.

special beneficiary

Special benefits are gifts for life received during the decedent's lifetime and gifts made by will (bequests).

This system is designed to make adjustments to be substantially fair to each heir by deeming as inherited property the sum total of the property received from the decedent as gifts during his/her lifetime and the property in existence at the time of the commencement of inheritance.

For example, an eldest son receives land with a market value of 10 million yen from his father (the decedent) before his death,The property is included in the estate and the estate tax is calculated.Note that the value of this property is determined based on the "value at the time of commencement of inheritance," so if this transferred land was worth 100 million yen, 100 million yen would be added to the inherited property.

In addition, if a spouse receives a gift of a residence home, there is a system that exempts the spouse from having to repossess the property. For details, please refer to "Systems to Protect the Remaining Spouse" below.

contribution

What is contribution?A co-heir who "made a special contribution to the maintenance or increase of the decedent's estate."The system is designed to increase the inheritance share of a contributor by the amount of special compensation equivalent to his or her contribution to the estate.

In principle, the amount of contribution is determined by consultation among all heirs, but if no agreement can be reached, the amount can be determined by mediation or trial by the family court.

For example, if the eldest son helped his father (the decedent) in his old age in order to support his father's livelihood, he is entitled to a share of contribution. However, since only "joint heirs" can claim contribution, even if the eldest son's wife took care of him in his old age, she cannot claim contribution. In addition, ordinary medical care and custody by a spouse or parent and child is not considered "special contribution.

If contribution is allowed, the amount of the estate is excluded from the inheritance and the contribution is added to the contributor's ultimately determined original inheritance share.

Special Contribution Scheme

What is the special contribution system?If a person other than the heir "has provided care and custody of the decedent without compensation."one's natureA system whereby money may be claimed against a successorIt is.

If an heir has devoted himself/herself to the decedent's medical care and custody, he/she can claim contribution in the partition agreement, but a person other than the heir, such as a common-law wife, cannot claim contribution no matter how much he/she has contributed.

The amount of the contribution (special contribution fee) is to be agreed upon by the parties concerned, but if the parties are unable to reach an agreement, they may request the family court to dispose of the fee. This system is not available after six months have passed since the start of the inheritance and knowledge of the heir, or after one year has passed since the start of the inheritance.

Special contribution fees received by a contributor from his or her heirs are considered to have been acquired by the contributor from the estate by bequest and are subject to estate tax.

A system to protect the remaining spouse

There are several systems in the Civil Code that protect the life of the surviving spouse.

The following columns will explain.

Disqualification and Disqualification from Inheritance

It is a system that deprives heirs of the right to inherit under certain circumstances.

Even if a person loses his/her right of inheritance under this system, his/her children and grandchildren can inherit by succession.

This differs from the case of "renunciation of inheritance" described above.

disqualification from inheritance

Disqualification from inheritance is when an heir has any of the disqualifications enumerated in the Civil Code below,It is a natural loss of inheritance rights without following any procedures.

- A person who has been sentenced to death for intentionally causing or attempting to cause the death of a decedent or a person of the same rank or priority with respect to inheritance.

- A person who commits an act of interference (forgery, alteration, destruction, concealment, etc.) with the decedent's will

(legal) exclusion or removal

Disinheritance is a situation in which the decedent is unable to allow a particular heir to inherit under the following circumstances.This is a system whereby a request is made to the family court and the heir's inheritance rights are forfeited by the judge.

- Abuse or insult to the decedent

- Significant misconduct of the presumed heir

This disinheritance can only be claimed against heirs who are presumed to have "intestate succession," as explained below. This is because, if the will indicates in the will that the heirs who do not have "intestate succession" are not to inherit, they can be disinherited at all.

heir's distributive share

This is a system that grants heirs the right to claim a certain amount of property (the right to claim the amount that infringes on the intestate estate) if the will left by the decedent specifies a method of disposing of property, such as "all property is to be inherited by mistress A".

Please refer to the separate column as this is a right that must be taken into consideration when preparing a will.

summary

How was it?

The Civil Code stipulates various systems for the equitable distribution of property among heirs.

A person who is a decedent shallThe system must be understood and the will must be carefully drafted, andThe heirs must properly claim the rights protected by each system.

It is essential to take early action with the help of each professional to prevent a contested inheritance.

Comments