Most people know that investing involves risk.

On the other hand, I feel that few people understand what that "risk" really means and which financial instruments have what level of risk.

I want to make money fast! I want to make money fast!" and "I want to hit the jackpot!" Some people start investing in leveraged financial instruments with the desire to "make money fast!" and then suddenly run away from their investments after suffering a huge loss.

It is true that investing involves risk.

It.If you fail without understanding or are overly afraid to move forward, your assets will never grow.

Today I would like to organize the knowledge needed to "properly understand the risks of investing" and establish the "most appropriate" investment approach.

Know the risks in your investment.

Think about the risks.

In everyday life we probably recognize the word "risk" as a "degree of danger. For example, the risk of meeting with disaster means "the possibility of being seriously injured by a disaster.

However, risk in investment is not only "suffering a loss" by investing, but also "earning a profit" is called "risk. In other words, by investing in assetsThe "volatility" of losses and earnings is called risk.

The common saying that "investing in stocks is high risk" means that the volatility is high, and while there is a possibility of large gains, there is also a possibility of large losses. Conversely, "savings accounts are low risk" means that although you cannot expect large returns, you are unlikely to suffer large losses.

We need to be reminded that risk is always present in our lives, not just in investments.

For example, there is always the risk of natural disasters, illness, and disaster even in our daily lives.

It is a mistake to think of risk in investment as "risk = danger. If you run away from investment because you are excessively afraid of risk, you will not be able toEven savings accounts are at risk, and just living is at risk.

Not many people would say, "I'm afraid of getting into an accident, so I won't ride in a car, train, or airplane, or even leave my house for one step. I am sure there are not many people who would say, "I will not ride in a car, train, or airplane because I am afraid of getting into an accident," but I think this idea is certainly reasonable.If you do not leave your home, you minimize the risk of having an accident. On the other hand, we need to take into account that we are missing out on time outside to enjoy with family and friends, a major "lost opportunity".

The same can be said about investing. By not investing because you are afraid of loss, you are avoiding the risk of a decrease in cash on hand, but you are also losing the opportunity to profit.

Just as no one would suddenly get into a racing car and drive it at very high speed, we do not recommend that you suddenly invest all your money in FX, but we do recommend that you invest after knowing the risks and being aware of the acceptable range of risk.

Know the standard deviation.

In Asset ManagementStandard Deviationis,It is a statistical measure of data scatter.It indicates how far the data are from the mean. A larger standard deviation means that the data are widely scattered from the mean, while a smaller standard deviation means that the data are concentrated in a range close to the mean.

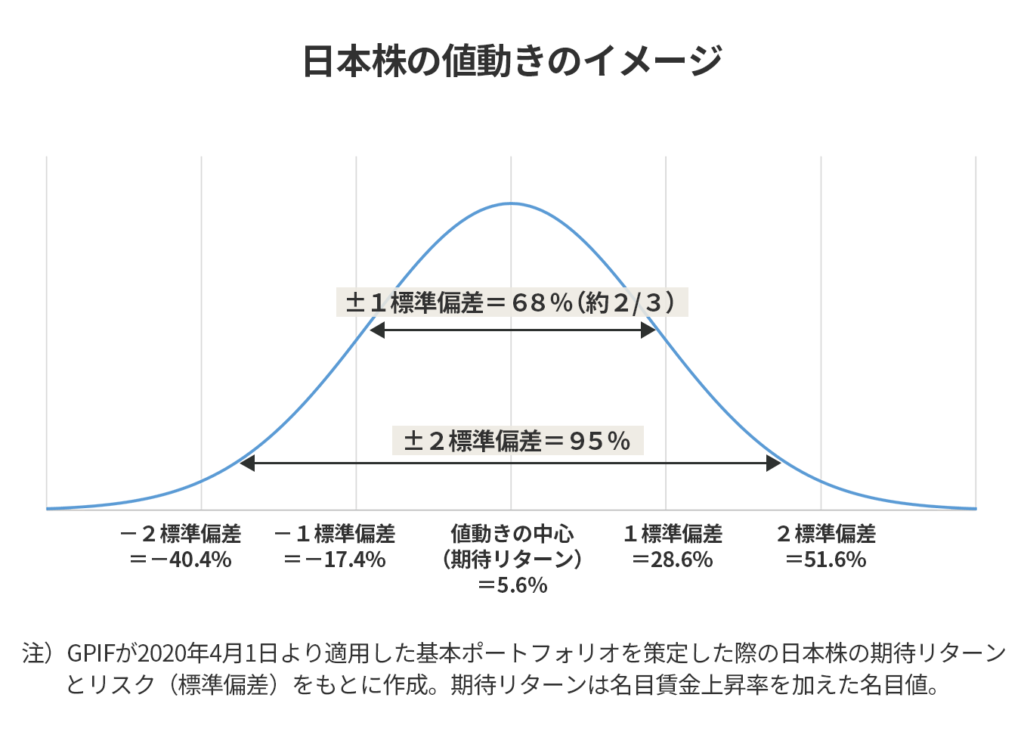

It is a statistical measure of the size of the spread of the distribution of returns and attempts to indicate how much the returns are likely to blur over the course of a year.Returns are expected to fall within ±1 standard deviation from the center about two-thirds of the time and within ±2 standard deviations 95% of the time.

Let's look specifically at this using the figures: "The expected return on Japanese stocks is 5.6% and the risk (standard deviation) is about 23%"*.

*Numbers used by the GPIF in formulating its basic portfolio, effective April 1, 2020. Expected returns are nominal values with wage growth added.

Risk is usually expressed as one standard deviation. If "the expected return on a Japanese stock is 5.6% and the risk (standard deviation) is about 23%," this means that there is about a two-thirds (about 68%) chance that the one-year return will be centered at the expected return of 5.6% and fluctuate between the upper and lower 23%. In other words, we assume that there is about a one-third chance that the one-year return will be in the range of plus 5.6% to plus 28.6%, and about a one-third chance that it will be in the range of plus 5.6% to minus 17.4%. Conversely, there is about a 16% probability that the annual return will be much lower than minus 17.4%, and about a 16% probability that it will be much higher than plus 28.6%.

(Exhibit:GPIF (Government Pension Investment Fund))

To illustrate with a simpler example, a mutual fund with an expected return of 5% and a standard deviation of 10% is purchased for 1 million yen,

5%-10%= minus 5%= 950,000 yen, 5% + 10%= plus 10%= 68% with a probability of falling between 1.1 million yen

5%-10%= minus 5%x2= minus 10%= ¥900,000, 5%+10%= plus 10%x2= plus 20% probability of falling between ¥1.2 million and 95%.

When choosing a financial product, it is of course dangerous to look only at the "expected return of 5%" in the above example, but it is important to be aware that the probability of a negative return is statistically at most negative 10% with a standard deviation of 10%.

In other words, if you invest only on the basis of expected returns, there is a possibility that your investment will not meet your expectations. On the other hand, you should also be aware that the probability of your valuable assets that you have invested going to zero is very low.

Incidentally, this statistical probability of 68% is also used for the forecast circle in the expected path of typhoons. In other words, the probability of a typhoon entering the forecast circle is 68%.

Of course, the standard deviation is a statistical data of the financial instrument, and it is possible for a profit to exceed the standard deviation or for a loss to fall far below the standard deviation. However, if you purchase a financial instrument after confirming the expected return and standard deviation, you will not have to worry about daily price fluctuations, and you will not be able to get any work done.

Risks to savings accounts?

Deposits are limited to 10 million yen per depositor per financial institution, up to the principal amount of 10 million yen and interest on the principal amount.deposit protection systemThe savings account is protected by the "bank's insurance policy". So is this savings account risk-free?

In May 2024, Japan saw a y/y price increase of 2.81 TP3T, according to the Ministry of Internal Affairs and Communications.

I am sure that all of you are aware of the rapid increase in the prices of things in your daily lives.

The price of a beef bowl has increased from 290 yen as of March 2018 to 400 yen as of July 2023. In about 5 years, the price will increase by about 1.4 times (140%). On the other hand, wages at major companies have barely increased by 51 TP3T in this year's Spring Struggle.

What this fact means is that nowAlthough the face value of 10 million yen deposited in the bank will remain unchanged at 10 million yen after 10 years, its real value will drop to 7.81 million yen assuming that prices continue to rise at 2.51 TP3T per year.After 20 years, it will be a whopping 6.1 million yen.

Of course, there is no guarantee that a situation like the deflationary Japanese society that lasted for more than 30 years since the late 1990s will not return, in which prices of goods continue to fall rather than rise, so it is not absolutely certain that savings accounts are a bad idea.

in shortEven savings accounts are at risk of having their real value impaired."That is to say.

5 Risks in Investing

Let me summarize the investment risks that you should be aware of when you are about to make an investment.

Price fluctuation risk

Prices of stocks and mutual funds rise and fall every moment of every day. Stock prices change not only according to the performance of the company, but also according to social and political conditions, and sometimes they fall sharply in value, resulting in losses.

credit risk

The risk that a company or country issuing stocks or bonds will default on its debt. Also called default risk. If a company or country goes bankrupt, in the worst case scenario, the entire principal amount may not be returned.

Foreign exchange fluctuation risk

Even if stock or bond prices themselves do not fall or even rise, there is still the risk of currency fluctuation if the financial instrument is denominated in a foreign currency. For example, if you purchase a mutual fund denominated in dollars and the dollar rises 101 TP3T after one year, you will gain 101 TP3T in dollars, but if the dollar falls 201 TP3T against the yen (yen appreciation), the price of the mutual fund in yen will fall 101 TP3T.

Interest rate fluctuation risk

Market interest rates have a significant impact on bond prices.

- Bond prices fall as interest rates rise

- Bonds issued at existing low interest rates will be less attractive than bonds issued after interest rates rise, so the price of those bonds will fall.

- Bond prices rise as interest rates fall

- When interest rates fall, newly issued bonds are less attractive than bonds issued when existing interest rates are higher, and more people buy bonds issued when existing interest rates are higher. Thus, existing bond prices will rise.

liquidity risk

Liquidity means ease of redemption.

Cash is the most liquid form of money and can be spent whenever and as much as desired. However, if the country issuing the cash goes into default or hyperinflation occurs, even cash cannot be spent freely.

For example, a five-year time deposit has an infinitesimal chance of losing principal, but it cannot be cancelled for five years before maturity (in fact, it can be cancelled, but in that case the promised interest rate is not guaranteed), which is also "liquidity risk".

summary

Risk in investment refers to the possibility that you may not receive the expected return or that the principal amount invested will be reduced. We hope you understand that there are different types of risk.

These risks fluctuate depending on economic conditions, corporate performance, policy changes, and natural disasters. It is important to understand the risks and to aim for long-term asset growth while minimizing losses through diversification and investments that match your risk tolerance.

First, please refer to the above example and consider how much loss you can tolerate.

It is generally said that you should have one year's worth of living expenses on hand in cash and invest the rest, but you need to consider whether this is right for you. Some people may feel secure with six months' worth of living expenses, while others may need two years' worth of living expenses.

Everyone's "risk tolerance" is different, and it depends on how experienced you are in investing. What is important,Just being alive is a risk, and you can't start being overly fearful of risk."and that,Ignoring risk and believing only in expected returns doesn't work the way you want it to."The first step is to start investing with the understanding that

Comments