Saving is not the only secret to growing your money. Did you know about the power of "compound interest," in which gradually increasing interest snowballs to boost your principal? Compound interest is,It is a very powerful tool in asset building.In this article, we will explain in simple terms how compound interest works and show you how to maximize its benefits.

People who should read this article

I have heard of compound interest, but what is it? What is it?

People who want to gain the knowledge necessary for asset building.

People who have just started investing or want to start investing

People who want to gain important knowledge about making investments.

What is compound interest?

Albert Einstein said.Those who understand compound interest make a lot of money, and those who don't understand it lose money."He also calls compound interest "the eighth wonder of the world" and "the greatest invention of mankind.

Compound interest refers to a system in which interest is earned on the principal plus its interest. That is, interest accumulates over time, not only on the principal,Because new interest is also earned on interest earned in the past, investments and savings snowball.

Recall that when building a snowman, a small lump of snow initially grows larger as it is rolled. The more you roll the snowman, the larger its surface area becomes, and the more snow it sticks to, the bigger it gets at an accelerated rate.

The same is true of investments: the larger the principal, the larger its surface area, and the more interest it earns, like snow that sticks together. Compared to simple interest (a system in which interest is paid only on the principal), the effect of compound interest increases over time. Especially in long-term asset management, compound interest is a very powerful tool for increasing money efficiently.

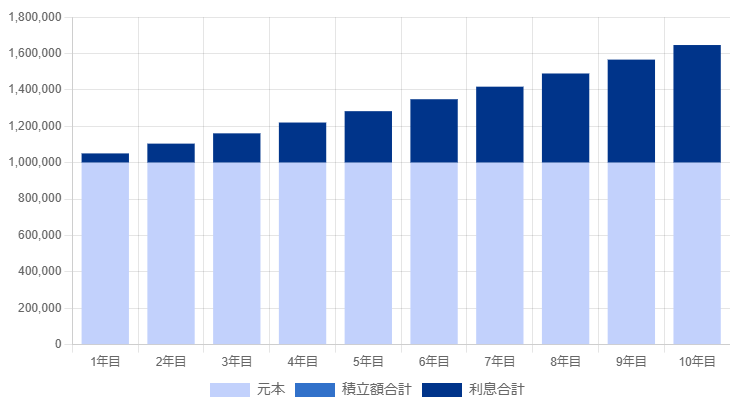

Visualizing the effects of compound interest

If 1,000,000 yen is invested at an annual interest rate of 5% without additional investment, the simple interest rate will be 1,050,000 yen after one year, and after two years, the principal amount of 1,000,000 yen with 5% interest will still be 1,100,000 yen,After 10 years, the amount will be 1.5 million yen.

If this is compounded, after one year, it is the same 1,050,000 yen, but in the second year, 51 TP3T of 1,050,000 yen becomes 1,125,000 yen,After 10 years, the amount will be 1,647,009 yen.

Investment strategies that take advantage of compound interest

The investment strategy using compound interest is,Very effective for increasing assets over timeThe following is a list of investment strategies and the key points to effectively manage them. Below are some typical investment strategies that take advantage of compound interest and the key points to effectively manage them.

1. Long-term investment strategy

- Basis of compounding effect: By continuing to invest over a long period of time, a state of "interest on top of interest" is created, in which not only the principal but also interest and dividends gradually increase, and interest is paid on top of that. To take advantage of this mechanism, it is important to start investing as early as possible and to increase assets over a long period of time.

- Financial instruments suitable for long-term investmentIndex funds and ETFs that are linked to overall market indices, such as the Nikkei 225, S&P 500, etc,Long-term investments in risk-diversified equity markets are recommended.This provides a steady return and maximizes the compounding effect.

Although returns on index investments are often lower than those on individual stock investments, by investing over the long term, one can expect accelerated asset growth due to the compound interest effect. Another feature of index investing is that it is overwhelmingly less risky than investing in individual stocks.

An active fund is a mutual fund in which the fund manager analyzes market and corporate trends and selects individual stocks to manage. The goal is to earn a higher return than the overall market (index). In other words, they aim to profit by actively trading to outperform the market.

For example, according to the SPIVA Report published annually by S&P Dow Jones Indices in the US,70-90% of active funds underperform the market average over the long termIt has been shown that It is extremely rare for active management to beat the market, especially over long periods of time, such as 10 or 15 years.

The fact that most institutional investors and fund managers who earn high salaries and analyze market trends every day cannot win, while we, the general public, have an infinitesimally small chance of winning even if we analyze market trends and make short-term trades.

Also, active funds recommended by brokerage firms charge more than 11 TP3T in fees, even though the chances of winning are low. Since these fees reduce the profit of the fund, it must be said that the possibility of profit in the long run is very low.

2. Accumulated Investment (Dollar Cost Averaging)

- Features of Dollar Cost Averaging: By investing a fixed amount each month, you can purchase less when prices are high and more when prices are low, thus leveling out the average acquisition price. Since the market tends to rise over time, you are more likely to benefit from compound interest over time.

For example, if you invest 1 million yen when the base price of a certain mutual fund is 10,000 yen, you can purchase 100 units, but when the price drops to 5,000 yen, you can double your investment and purchase 200 units. In this case, the average purchase price is

10,000 yen x 100 units + 5,000 yen x 200 units / 2 / 300 units = 6,666 yen

The first two are the following.

By repeating this process, the average purchase price will level out.

Another advantage of this purchase method is that you are not swayed by the trend of the stock price. Even if the stock price falls and you have an unrealized loss, you can purchase more shares at a lower price and have high expectations for a large future growth. - execution method: By investing in accumulations on a regular basis, the power of compound interest kicks in and your assets will snowball. If young people in particular start accumulating early, they will increase their chances of earning large long-term gains. If you set up an accumulation account at an online brokerage or other financial institution, it will automatically purchase a predetermined product at a predetermined amount on a predetermined date each month. You can continue to invest without being distracted by fluctuations in stock prices or base prices.

This episode took place when Fidelity, a large investment firm, surveyed the performance of its clients,It turns out that the accounts with the highest returns were actually those of "deceased investors" or "investors who had forgotten about their accounts altogether"This is based on the story that What this means is that in investing, short-term buying and selling and emotional behavior often lead to poor returns,The best strategy is to leave it alone and let it grow over time.This is the point that the

3. dividend reinvestment strategy

- Importance of dividend reinvestmentThe effect of compounding is further accelerated by reinvesting dividends earned from stocks and funds instead of consuming them outright. Dividends provide an additional source of capital, which is reinvested to create a cycle of principal growth and additional interest on that principal.

- execution method: You can effectively grow your assets by choosing stocks of dividend-paying companies or funds that can reinvest dividends and are set up to reinvest dividends. Many funds that pay out monthly or semi-annual distributions are products that pay out promised distributions even if they are not profitable. They are called "octopus-limb dividends" in the same way that an octopus eats its own limbs. In these products, the principal itself is likely to be damaged, rather than the effect of compound interest.

4. rebalancing strategy

- Balance of risk and returnThe portfolio can be rebalanced periodically, selling off assets that have become too risky and allocating them to safer assets, thereby achieving a stable return. This allows you to maintain long-term growth while minimizing the risk of damaging the compounding effect.

- execution method: Once or twice a year, it is recommended to review the composition of the portfolio and rebalance it to optimize the ratio of stocks, bonds, cash, and other assets.

6. Maximize the compounding effect by taking advantage of tax incentives

- Use NISA or iDeCo: Tax benefit programs reduce taxes on interest and dividends, allowing you to take full advantage of the compounding effect. NISA and iDeCo are particularly advantageous systems for long-term asset management, where the entire amount invested may be tax-exempt.

summary

How was it?

By taking full advantage of the compounding effect and investing in savings over a long period of time (at least 5 to 10 years), your assets are expected to grow significantly.

- Start early.The sooner you invest: the sooner you invest, the better, because the compounding effect works over the long term.

- Invest regularly: Instead of investing a large amount at one time, diversify risk by accumulating funds on a regular basis.

- Be patient and persistentThe key to maximizing the compounding effect is not to chase short-term gains, but to keep investing for the long term.

- continue to learnInvestment theory and the economy: By continuing to learn about the theory of investment and how the economy works, your investment grip will increase.

By incorporating these strategies, you can effectively grow your assets while taking full advantage of the power of compound interest.

Investments are your own responsibility and no one can guarantee you a profit. At times, the principal amount invested is often halved. HoweverAssets will grow at a fairly high rate if you continue to act with high expectations within the limits of your spare funds.

If you have any concerns or questions, we recommend that you seek the opinion of a professional, such as an independent financial planner, rather than a financial institution, to fully understand the situation before you start investing.

Comments