Orcan investments (all-country investments) are,It has attracted attention in recent years as a way to diversify broadly across the world's stock markets.By investing in a wide range of countries, from developed to emerging economies, without being biased toward any particular country or region, it is possible to aim for long-term asset building while diversifying risks. This article explains the basic structure, advantages and disadvantages of Orcan investment, as well as some easy-to-understand points for investment beginners. It is a must-see for those who are considering investing with an eye to the world as a whole.

People who should read this article

People who are anxious to start investing

What's the buzz about the All Country Index? If you're one of those people who say, "What is the All Country Index?

People are confused between the mutual fund Orcan and the S&P 500.

Conclusion.

People who think the U.S. will never grow up are the S&P 500.

Japanese index funds for those who think "Japan will definitely grow."

Orcan those who are "worried that the world will grow but be biased toward the U.S."

What is the popular mutual fund "All Country"?

The "All Country Index Fund" or "Orcan" is a mutual fund that can invest in companies from a wide range of countries, and has become a popular product along with the S&P 500, which invests in U.S. stocks, in the new NISA that began in 2024.

Specifically,MSCI ACWI (Stock price index calculated by "MSCI All Country World Index (Morgan Stanley Capital International Inc.)")is a typical all-country index, and funds that aim for similar performance using this index as a benchmark are commonly referred to as "orcas," which are mutual funds sold by various management companies. This article focuses primarily on the "eMAXIS Slim All World Equity (All Country)Here is an example of a "good" example.

All Country Index Features

- Global Diversification

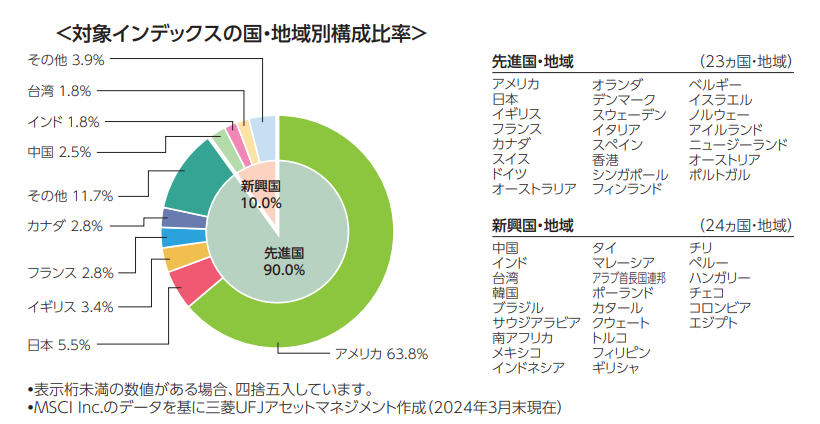

The most important features of the All Country Index are,By investing in companies around the world, the company is not dependent on any particular country or region, which provides a high degree of risk diversification.Orcan's investment portfolio includes the United States, Europe, Japan, and emerging markets,It covers 851 TP3T of stocks worldwide, spanning 47 countries and approximately 2,800 issues.Calibrated stocks are determined on a "market capitalization weighted average" basis and reviewed four times a year. Since the investment targets are spread across various markets, individual market risks can be reduced. Even beginners can easily make global investments because they can invest in a wide range of stock markets throughout the world just by investing in one index. - Coverage of developed and emerging countries

The investment targets include not only companies in developed markets (such as the U.S., Europe, and Japan), but also companies in emerging markets such as India and Brazil, which are said to be poised for significant economic growth in the future,You can also invest in companies in countries with growth potential.The market is expected to grow over the long term as it can enjoy global economic growth. Also, since there are a large number of stocks, the risk of being affected by the decline of a particular stock is relatively small. - Long-term growth potential

Because the value of the company can be expected to increase with the overall growth of the global economy,It is suitable for long-term asset building.The appeal of this product is that it allows you to invest in the growth of the entire world without concentrating your risk in a specific country or region.

Market capitalization weighted average(Market Capitalization-Weighted Average) is a method of calculating how a particular index or fund reflects its constituent stocks in the stock market. A company'smarket capitalizationThe result is averaged by weighting the influence of the company's shares according to the

Market capitalization-weighted averages are weighted averages based on the market value of each company and are widely used as a calculation method for indices and funds. While it easily reflects overall market trends, it is also characterized by its dependence on large companies.

structure

- market capitalization:

It is the share price of each company multiplied by the number of shares outstanding, which indicates the market value of that company. In other words,The larger the company, the larger its market capitalization.- Market capitalization = share price × number of shares outstanding

- Market capitalization = share price × number of shares outstanding

- weighted average:

The larger the market capitalization of a constituent company, the greater the impact of its stock price fluctuations on the overall index.It is. In other words, stock price fluctuations of companies with large market capitalization strongly affect the overall index movement.

Advantages of Market Capitalization-Weighted Averages

- Reflects the reality of the market:

It captures actual market trends well because it can accurately reflect the impact of large companies on the overall market. - stability:

Companies with large market capitalizations usually have relatively low stock price volatility (fluctuations), and index fluctuations tend to be moderate. - Natural AdjustmentThe market capitalization is automatically adjusted in accordance with market fluctuations, reducing the need for portfolio rebalancing (reallocation of asset allocation).

Typical market capitalization-weighted indices include, in addition to Orcan

- S&P 500: An index consisting of a market capitalization-weighted average of the 500 largest U.S. companies.

- Nikkei Stock Average (price)uses a simple average of stock prices, while TOPIX (Tokyo Stock Price Index) uses a market capitalization-weighted average of Japanese listed companies.

weakness

- be biased toward large corporations:

The impact of companies with large market capitalization on the index will be excessive, making it difficult to reflect the stock price trends of smaller companies. - bubble risk: If the market capitalization of a particular company or sector becomes unusually high, there is a risk that the entire index will be dependent on that company or sector.

What are the risks of Orcan?

Let's take a look at the risks of this excellent investment product, Orcan.

While investing in Orcan (a global equity index fund) has many advantages, it also carries some risks. Understanding these risks is very important in making an investment decision. Below are the main risks associated with investing in Orcan.

Depends on the market as a whole

When the overall global market declines, the All Country Index is also affected.

Even though "index funds are low-risk," their investment universe is 1001 TP3T in equities. During periods when the overall market crashes, there is a risk that the value of your investment will be significantly reduced. Since the fund does not diversify into asset classes that hedge risk, such as bonds or gold, there is a risk that when the stock market falls, the entire portfolio will fall as well.

exchange risk

Orcan invests in stock markets around the world, including not only Japan, but also the United States, Europe, and emerging markets. Therefore,You will be investing in assets denominated in foreign currencies, and exchange rate fluctuations may affect your investment returns. If the Japanese yen strengthens sharply against other currencies (yen appreciation), there is a risk that the value of assets denominated in foreign currencies will diminish. Conversely, a weaker yen can increase returns, but one of the risks is that investment results are affected by exchange rate fluctuations.

Country and regional risks

Orcan invests in both developed and emerging markets.Emerging markets are particularly vulnerable to political instability, economic uncertainty, and regulatory risk, and sudden policy changes or economic turmoil in these countries can have a significant impact on the stock market. Emerging markets tend to be particularly volatile, with high returns but also high risks. Geopolitical risks (e.g., wars and civil unrest), natural disasters, and epidemics are also risk factors.

Dependence on U.S. companies

As you can see in the component stocks above, even though we invest worldwide, the companies' market capitalization determines where we invest,Its investments are 641 TP3T in U.S. companies. In other words, the performance of U.S. companies is strongly reflected in its performance.

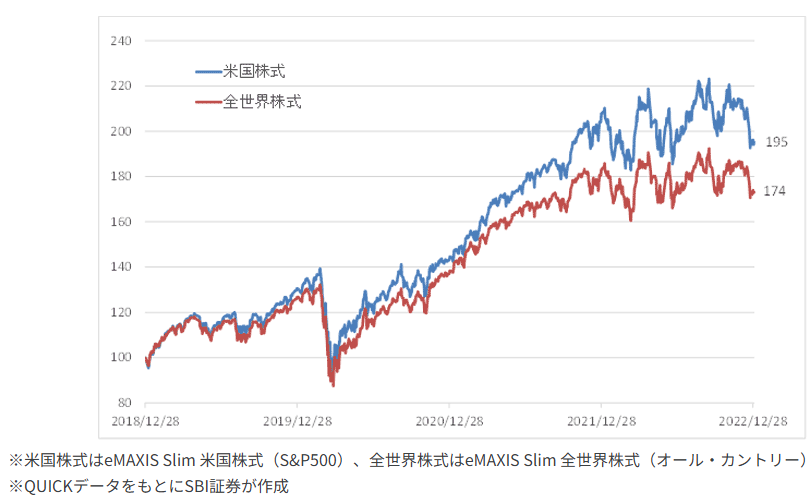

The question becomes, "If more than half of the stocks are U.S. companies anyway, why not just stick with the S&P 500?" As a matter of fact, as the chart below shows, the U.S. has grown remarkably over the past few years,As a result of the drag from non-U.S. countries, the Orcan performed worse than the S&P 500.

(Source:SBI Securities)

What are the benefits of Orcan?

Next, let's look at the benefits of investing in Orcan.

Maximize diversification effect

- Geographic Dispersion:.

Because we invest in equity markets around the world, we are not biased toward the risks of any one country or region, and our geographic diversification is very efficient. This reduces the impact of economic crisis or political risk in one country on the overall portfolio. - Industry Diversification:.

Because we invest in companies in a variety of industries around the world, the overall impact of a downturn in the performance of a particular industry or company is minimized.

risk diversification

Investing in Orcan provides a broad diversification of risk by offering a balanced investment in the stock markets of developed countries (such as the United States and major European countries) and emerging markets (such as India, China, and Brazil). Since you are not overly dependent on one country or one company, your risk is reduced in the long run.

low cost

Because Orcan is an index fund,Instead of individual stock selection by the fund manager, the fund is managed in conjunction with an index. This is characterized by low management costs.In particular, there are quite a few low-cost funds on the market these days, which are low-cost and suitable for long-term investments.

A simple way to invest

The advantage is that the ability to diversify across the entire world allows for a simple investment strategy without the need to consider additional investments in other individual asset classes or regions. In particular,It is also suitable for "leave-it-alone" investments that can be left alone without complicated adjustments for long-term asset building.

We can invest in growing countries.

It is also included in emerging and growth markets, allowing you to invest in countries that are expected to experience economic growth in the future.Emerging markets such as India, with its high economic growth rate, have the potential to generate large returns in the future, balancing risk and return.

Reap the benefits of long-term growth

The global economy has continued to grow over the long term, and it is likely that through Orcan we will be able to reap the benefits of global economic growth as a whole.You can participate in global growth with a broadly diversified portfolio that is not dependent on any particular country or regional economy.

Less need for rebalancing

Because it automatically invests in the entire global stock market, there is no need to rebalance individual stocks or regions.This is an advantage that allows investors to proceed with long-term asset building without hassle.

As explained above, the components of All Country are "market capitalization weighted". As a result, U.S. companies account for 63.81 TP3T of the component stocks. The component stocks are reviewed annually in February, May, August, and November. In the past year, the component stocks have changed as follows.

- U.S. companies: Addition 8 / Deletion 42 = -34

- Japanese companies: Addition 3 / Deletion 39 = -36

- Chinese companies: Addition 36 / Deletion 201 = -165

- Indian companies: 34 added / 4 deleted = +30

As you can see, many Indian companies were added to the component while Chinese companies were significantly reduced.

Also, when Russia began its invasion of Ukraine, we excluded all Russian companies from our investments.

summary

How was it?

Orcan (Global Equity Fund) is,Broad Diversificationand efficiently realize theA major advantage is that it allows investors to invest in the growth of the global economy as a whole while reducing risk.Long-Term Asset Formationand are particularly suitable for those who want to invest without hassle. The low cost of the product also reduces the cost of investment.

On the other hand, compared to funds that concentrate on U.S. stocks such as the S&P 500, investments in individual stocks of growing companies, or investments in the Japanese market that avoid currency risk, there are many complex risks involved. Also, if either developed countries such as the U.S., Europe, and Japan, or emerging countries such as India experience extreme growth, there is certainly a disadvantage that the Orcan, which encompasses other countries, will not be able to benefit from that growth.

In conclusion, if there is a particular company or country that you believe will "definitely grow!" you will get the best performance if you buy index funds or individual stocks of that country. On the other hand, if you think, "The U.S. will grow, but emerging countries will also grow rapidly,Orcan is an excellent product that includes emerging market equities but constantly rebalances them to minimize their risk.

Comments