Insurance is an important means of protecting property and health against unpredictable risks and accidents. In today's society, a wide variety of insurance products are offered to protect against illness, accidents, disasters, and other unforeseen events. There are different types of insurance, such as life insurance, medical insurance, automobile insurance, and fire insurance, each covering different risks. This article provides an easy-to-understand explanation of the basic purposes and types of insurance.

People who should read this article

People who have purchased insurance somewhat at the recommendation of others.

People considering life insurance for their families.

People who want to make sure that their current insurance policy is appropriate for them.

People considering insurance

People who think insurance is "part of savings".

Purpose and type of insurance

Insurance is designed to cover you and your family's financial risk in the event of an emergency.Its purpose is different from saving and investing.We often see people purchasing insurance as an "alternative to savings," but there are many other options for financial products designed to save money,It must be said that considering insurance as a savings product is very unfavorable.

Insurance is insurance." Properly consider the necessary and appropriate insurance coverage for you and your family today, taking into account your age, income, family structure, and other factors.

What do you need insurance for?

For families with children, it is common for the living expenses for surviving family members and educational expenses for children to be in the tens of millions of yen, which are necessary in the event that the head of the household should die. It takes a considerable amount of time to cover such a large sum of money with savings.

If you buy insurance,You can be assured of the coverage you need in the event of an emergency at the time of enrollment.

The major advantage is that you can prepare "now" for future risks that you may not know when they will occur.

Conversely, continuing to pay insurance premiums thinking that you are saving money when you have sufficient assets to meet your needs in the event of an emergency or after your children have become independent and you no longer plan to incur major expenses in the future is an unnecessary expense.

Know what insurance you should purchase.

When purchasing insurance, it is important to be clear about its purpose.Are there any insurance policies that you have purchased because they were recommended by family or friends without understanding the details of that insurance product? You need to purchase the necessary insurance for you and your family without over- or under-purchasing.

Insurance in the event of an emergency to the head of household

- Whole life insurance:Lifetime coverage

An insurance policy that provides a lifetime death benefit. Since a portion of the premiums are accumulated, a surrender value (money returned when the policy is cancelled) can be saved. However, because of its savings nature, the premiums are higher than those of a discarded policy. In addition, the principal amount may be lost if the policy is cancelled before a certain period of time has elapsed after enrollment.

Furthermore, even if you purchase insurance for the purpose of surrender value, the interest rate on the surrender value is generally less than the profit you can earn from investments and other sources. If your goal is to save money, we recommend that you choose a different financial product. - Term insurance:Lump-sum insurance with a fixed term of insurance

An insurance policy to secure death benefit for a certain period of time. The period of coverage is fixed in advance, and the premiums are discarded. Premiums are lower than those of whole life insurance, and there are also renewal types that increase premiums with each renewal.

It is recommended that you join the plan only for as long as you need to, such as until your child becomes independent. - Income protection insurance:Premiums are less expensive than term insurance

A type of term insurance in which the survivor receives a death benefit in the form of a monthly or annual annuity or lump sum in the event of the insured's death. Because the total amount of the insurance benefit decreases gradually over the years, the premium is less expensive than term insurance, in which the amount of insurance is constant until maturity.

Unlike life insurance, which pays a lump sum at once, the benefit is paid monthly or annually over a fixed period of time,It can stably supplement the living and educational expenses of the remaining family members.

The benefit period can be selected at the time of contracting, for example, until the insured's children reach adulthood or to coincide with the mortgage repayment period. The total benefit amount decreases as the policy term progresses, with a larger total benefit in the event of death after the inception of the policy, and a smaller benefit as the term progresses. This makes it suitable for families with progressively smaller amounts of coverage required.

Insurance against illness and injury

- Medical Insurance:Insurance against hospitalization and surgery

You may suddenly become ill, suffer an injury, or encounter other troubles at any time. This insurance is designed to cover medical expenses for surgery and hospitalization in such cases. There are two types of insurance depending on the term of the policy: whole life type, which provides coverage for the entire life of the policy, and term type, which provides coverage for a fixed period of time. The premium for the term type generally increases with each renewal. - Cancer Insurance:Insurance focused on cancer treatment and surgery

This is an insurance policy that focuses on cancer as a target of coverage. Cancer accounts for about 30% of all deaths in Japan and is one of the major causes of death, along with heart disease and cerebrovascular disease, even in recent years when medical technology has advanced. Cancer insurance provides benefits for hospitalization, surgery, and hospital visits due to cancer. Cancer insurance that provides a lump-sum payment upon diagnosis of cancer is also becoming more common. It should be considered as a supplemental insurance to the medical insurance mentioned above. - Long-term care insurance:Insurance to cover the costs of long-term care

An insurance policy that provides benefits when a person is certified as requiring a certain level of long-term care. This insurance is considered to be a supplement to public long-term care insurance. There are types of insurance that provide a lifetime annuity upon certification of the need for long-term care, types that provide an annuity for a certain period of time, and types that provide a lump-sum payment upon certification of the need for long-term care.

Insurance to prepare future education and retirement funds

- Children's insurance (student insurance):Prepare for children's education expenses

Insurance to cover future educational expenses, such as a child's enrollment in college. The maturity period varies from 15 to 22 years of age, and there are a variety of types of insurance policies that provide a gift or maturity payment at a certain time, as well as annual payments while the child is in college.

This refers to an insurance product that combines the function of insurance coverage while providing funds for children's future education and living expenses. In addition to saving for education funds, the product has the feature of both savings and security, as it comes with a guarantee in case something happens to the policyholder or the insured (child). - Individual annuities:Building a retirement fund with insurance

This type of insurance is used to prepare funds for retirement in advance. There are several types of insurance, including those that allow the insured person to receive an annuity during his/her lifetime, fixed annuities with a fixed payout period and annuity amount, variable annuities where the annuity amount increases or decreases depending on investment, and those that are invested in a foreign currency such as the US dollar.

Property insurance against accidents and natural disasters

Property insurance is designed to compensate for losses caused by accidents and disasters, and there are many types of insurance. The main ones are.Damage to propertyand ... andliabilityand a variety of risk-based products are offered. The following are typical types of non-life insurance

- automobile insurance

It is an insurance policy that compensates for damages related to motor vehicle accidents. Compulsory automobile liability insurance, which all car owners are required to have and compensates at a minimum for bodily injury to victims of traffic accidents, andThere are voluntary insurance policies that cover the areas not covered by liability insurance (e.g., bodily injury, property damage, personal injury, and vehicle insurance). - fire insurance

Insurance to protect your home from fire and other disasters. There is "Residential Fire Insurance" that covers damages caused by fire, lightning, explosion, wind, hail, and snow, and "Comprehensive Residential Insurance" that covers these disasters as well as falling, flying, or colliding objects from outside the building, water leakage, theft, labor disputes, and water damage.

Fire insurance does not cover damage caused by earthquakes, eruptions, or tsunamis. - earthquake insurance

The purpose of this insurance is to help victims of earthquakes and other disasters to rebuild their lives, and is based on a system in which the government shares part of the insurance liability of private insurance companies. It is important to note that,Earthquake insurance cannot be purchased on its own and must always be purchased in combination with fire insurance.

Since earthquake insurance is intended solely for the purpose of rebuilding the lives of disaster victims, unlike fire insurance, the amount of compensation is limited to 30% to 50% of the fire insurance policy amount, up to 50 million yen for buildings, and up to 10 million yen for household goods. - accident insurance

This insurance covers injuries, death, and disability caused by accidents. There are many insurance products for individuals that cover medical expenses, hospitalization, death benefits, etc., as well as overseas travel insurance. - Other non-life insurance

Compensation Insurance" to compensate for damages caused to others, "Traffic Accident Accident Insurance" specifically for injuries caused by traffic accidents, "Marine Insurance" to compensate for damages related to marine transportation, "Comprehensive Personal Property Insurance" to compensate for damages to specific movable assets such as household goods, merchandise, and equipment, and "Pet Insurance" to cover medical expenses for pets, Event Insurance" to compensate for damages caused by cancellation of events or accidents, "Golfer Insurance" to compensate for accidents or damages while golfing, and many other insurance products.

Prioritize and purchase insurance for different purposes

If you try to insure against all risks, the cost of insurance premiums can be prohibitive. If you have a stay-at-home spouse or a family with small children, the first priority is to secure death benefits to support the family in the event of an emergency. Next, consider medical coverage, and finally, educational and retirement expenses.

However,It is necessary to carefully consider whether medical coverage can be provided by other systems such as the "high-cost medical care benefit system.It is also important to consider education and retirement funds at the same time, as there are many other advantageous financial products available.

For a single person, it is sufficient to first secure medical insurance and then consider death coverage for about the cost of a funeral.

Priority 1) Death insurance for head of household

If the head of the household who supports the family finances should die, the surviving family members would lose not only emotional support but also financial support. To ensure that the surviving family members do not have to worry about their financial situation, it is advisable to provide necessary coverage for living expenses, educational expenses, etc. with insurance.It is advisable to have adequate death insurance, especially when children are young.

However, while some products, such as savings-type death insurance, may appear attractive at first glance because "you can also save money," most of these products have high commission rates and many of them will result in a loss of principal if you cancel before maturity. When purchasing death insurance,We recommend a simple, low-premium, lump-sum insurance policy that specializes in death benefit coverage.

Furthermore, in the event of an emergency, the surviving family may receive a public survivor's pension or, if you are a company employee, a death benefit from the company. It is important to know the appropriate amount of compensation and to choose the appropriate insurance policy.

Priority 2) Medical insurance

Private medical insurance is intended to compensate for shortfalls in health insurance.If you are between 6 and 70 years old and covered by health insurance, the health insurance will pay 70% of the medical expenses incurred, and the remaining 30% will be paid by you.

moreoverIt is necessary to understand the medical expenses that can be covered by health insurance, such as the "high-cost medical care cost system" and the system of compensation for high medical expenses by the respective insurance societies.

Since the cost of bed balance and technical fees for advanced medical treatment, etc., which are not covered by health insurance, are to be borne entirely by the patient, it is recommended that these expenses be covered by medical insurance. HoweverIf you can cover these out-of-pocket expenses with your own assets, there is no need to pay high premiums to purchase medical insurance.

Priority 3) Spousal death insurance

Similar to the death insurance for the head of household in priority 1), in the case of a dual-earner household where the spouse supports part of the family income, or in the case of a family raising children where the spouse who works as a full-time housewife or part-time dies, it will be necessary to cover the cost of housework and childcare through other means (e.g., housekeeping or childcare services). In this case, the spouse must pay for the housework and childcare in other ways.

It also serves as a source of funds to cover funeral and medical expenses incurred in the event of death.

Priority 4: Child insurance, retirement insurance, etc.

This insurance is designed to prepare funds for education and retirement, which are said to be the three major expenses in life along with home purchase funds.

This insurance is designed to efficiently prepare funds to meet the financial needs of children entering high school or college, or for individual annuities to cover living expenses after retirement. It is considered to be an insurance policy that combines savings and security features.

juvenile insuranceallows for the preparation of funds for education in a planned and efficient manner by paying a fixed monthly amount. Also,In the event of a contingency to the policyholder (parent), subsequent premium payments will be waived and the scheduled educational expenses (insurance benefits) will be paid, among other benefits.

personal pension insurancepays premiums for a certain period of time,This insurance is to be received in the form of an annuity in old age and is used as a supplement to the public pension plan.Some types offer certain additional coverage in addition to retirement funds, such as hospitalization benefits.

whole life insurancewhile having a lifetime death benefit,This insurance policy also allows the surrender value to be used as a retirement fund.

Insurance coverage, the concept of the required amount of coverage

The most important factor when choosing an insurance product,This is a guarantee in the event of an emergency to the head of the household.For the sake of your family, it is a good idea to consider early on the necessary provisions and choose the necessary insurance,It is very important to obtain sufficient coverage and to avoid incurring unnecessary premiums.

Try to imagine the life of the bereaved family in the event of an emergency.

When the head of the household who supports the family finances dies, the surviving family members lose not only emotional support but also financial support. It is important to provide the necessary amount of insurance coverage for living expenses, educational expenses, and other necessary expenses so that the surviving family members will not have to worry about their finances in the event of an emergency.

The amount of death benefit needed for the head of household will vary greatly depending on how the surviving family members live and work afterwards, as well as the children's plans for higher education. It is important to discuss this with family members at an early stage and to have as concrete an image as possible. Then, make preparations so that the necessary amount of coverage can be covered by insurance.

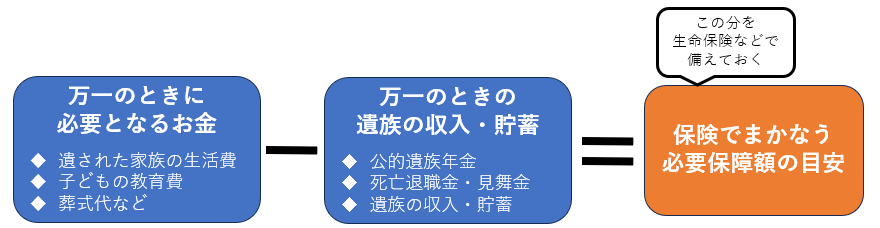

Concept of Required Security Amount for Survivors

The next thing to check is the concept of the required amount of coverage you want to have in your insurance policy.The basis of insurance is to provide for any shortfall in survivor pensions and savings.

In the event of an emergency, surviving family members will often be entitled to receive a public survivor's pension. If the head of the household was a company employee, the company may also provide a death benefit or a lump-sum payment. There is no need for the surviving family members to cover all their financial needs through insurance.

For this reason, the amount of necessary coverage can be estimated by subtracting "income and savings of the surviving family members in the event of an emergency" from "money to be spent in the event of an emergency" such as living expenses and educational expenses of the surviving family members. In order to know the appropriate amount of coverage, it is advisable to check the amount of money that can be received under the public survivor's pension or the company's system.

There are two types of survivor's pensions: the "basic survivor's pension" that spouses or children under 18 years of age can receive, and the "survivor's welfare pension" that survivors whose livelihood was supported by a member of the welfare pension system can receive when that person dies. In addition, wives who were 40 years old or older and had no children when their company employee husbands died, or wives who were 40 years old or older when their basic survivor's pension payments ended, can also receive "additional allowance for middle-aged and elderly widows" until age 65.

basic survivor's pension

Spouses or children with children under 18 years of age can receive

If you have a spouse

Basic amount (approx. 800,000 yen) + up to second child (approx. 230,000 yen each)

*About 76,000 yen for the third child and onward

survivor's pension

Survivors of company employees can get

3/4 of the old-age pension of the deceased

additional allowance for middle-aged and older widows

Wives who are over 40 years old and have no children when their company employee husbands die, and wives over 40 years old who have finished receiving the basic survivor's pension are entitled to it until age 65.

Approx. 600,000 yen

The above is a guideline. For more information, please consult with a pension office, laborer, FP, or other specialist.

Know the basics of medical insurance and long-term care insurance.

Private medical insurance is meant to make up for the shortfall in health insurance.In Japan, which has a well-developed universal health insurance system, is the current medical insurance really necessary?Consider the coverage you need after carefully understanding the health insurance system.

How much will I have to pay out-of-pocket for medical expenses?

The basic idea is that private medical insurance secures coverage for the portion of the cost that is insufficient for health insurance. If you are between 6 (school age) and 70 years old and have health insurance, your health insurance will cover 70% of the cost of your medical expenses, so the co-payment you have to pay at the hospital is only 30%.

furthermoreThere is a cap on the co-payment of medical expenses per month, which is limited to a maximum of 90,000 yen.

In addition, even those who are healthy now may have health concerns as they age. First of all, medical expenses are, in principle, covered at 20% for those between the ages of 70 and 74 (30% for those with a certain level of income) who are enrolled in a health insurance system. In addition, the public long-term care insurance system provides long-term care services for those who require assistance or care at a cost of 10% to 30%, depending on their income.

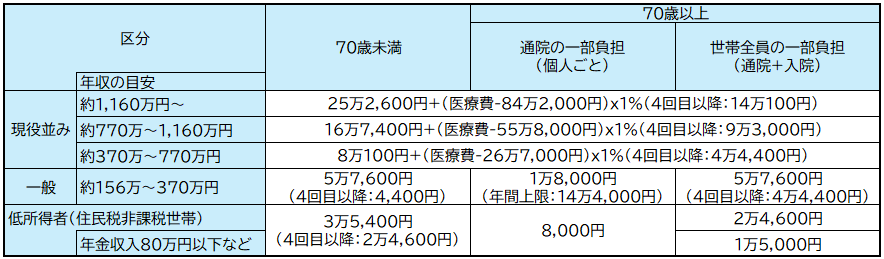

Know that there is a cap on your monthly medical expenses.

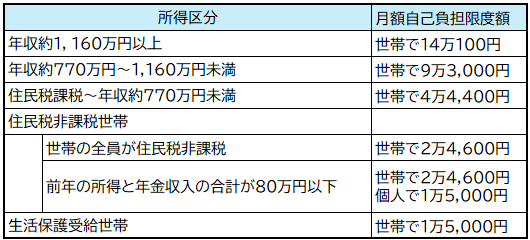

The health insurance system has a "high-cost medical care reimbursement system" to reduce the burden when the out-of-pocket expenses become too high. Under this system, if the monthly co-payment for medical expenses exceeds a set limit, the excess amount will be reimbursed at a later date. The maximum co-payment amount is determined according to income, for example, for those with annual income of approximately 3.7 to 7.7 million yen,

The maximum amount per month is 80,100 yen + (total medical expenses - 267,000 yen) x 1%.

It is almost always in the $90,000 range.

In addition, those who are 70 years of age or older and whose annual income is in the general category are capped at 18,000 yen per month for outpatient only and 57,000 yen per month for outpatient plus hospitalization, further reducing their burden.

Maximum amount of co-payment for medical expenses per month

The reason why the approximate annual income is "about" is because the income category is determined by the "monthly standard remuneration".

The "standard monthly remuneration" is the amount of money used as the basis for calculating insurance premiums and benefits in health insurance and employee pension insurance, and is established to classify and calculate a certain range of salary and remuneration. For details, please check with a specialist.

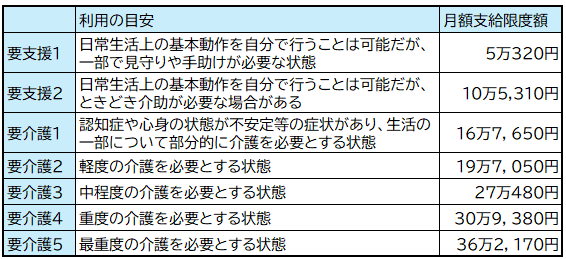

Let's learn how long-term care insurance works.

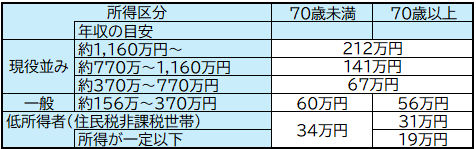

Those who have applied for and been certified by the municipal government as requiring long-term care or nursing care are eligible to receive nursing care services according to the level of care they require. The maximum amount of nursing care services per month is set according to the level of nursing care required, and preventive services and nursing care services are provided within this limit.Co-payments range from 10% to 30% of the service amount.However, when services are used in excess of this limit or when services not covered by long-term care insurance are used, the full amount is to be paid out-of-pocket.

For example, if a household is subject to resident tax and has an annual income of less than approximately 7.7 million yen, the maximum co-payment is 44,400 yen per month, and any excess amount will be reimbursed at a later date.

Payment limits for each level of care required for home care services (of which 10% to 30% are to be paid by the customer) and guidelines for use.

High-cost nursing (preventive) care service expenses (reimbursed for amounts in excess of the out-of-pocket maximums listed below)

The reason why the income category is "about" is because the income category is determined by the "monthly standard remuneration.

The "standard monthly remuneration" is the amount of money used as the basis for calculating insurance premiums and benefits in health insurance and employee pension insurance, and is established to classify and calculate a certain range of salary and remuneration. For details, please check with a specialist.

There is also a cap on combined medical and nursing care co-payments.

For the elderly, both medical and nursing care costs may be incurred, and their out-of-pocket expenses may be high.

In order to reduce this burden, there is also an upper limit set for co-payment of medical and nursing care expenses for one year (from August to July of the following year). For example, if a person is 70 years old or older and has an annual income in the general category, the upper limit is 560,000 yen.

The amount by which a household's annual out-of-pocket medical and nursing care expenses exceed this amount will be reimbursed by the medical insurance as "high-cost combined nursing care treatment expenses" and by the nursing care insurance as "high-cost combined medical care and nursing care service expenses.

For a typical income, the maximum amount for medical and nursing care expenses combined is approximately 560,000 yen to 600,000 yen per year.

Maximum annual co-payments for medical insurance and long-term care insurance combined

Summary, Medical and Long-Term Care Insurance Concepts

As mentioned above, in Japan with its well-developed health insurance system, medical expenses are kept to a certain level, and expensive medical and long-term care insurance is often a waste of money. In general, it is safe to assume that medical insurance is not necessary.

On the other hand, advanced medical treatment and unapproved drugs in case of cancer and other diseases, treatment for cosmetic and preventive purposes, and differential bed charges (private room charges),There may be cases where public medical insurance (health insurance) does not apply.If you think you need private medical insurance to cover these risks, you should consider it. If you are purchasing medical insurance for such risks, you should consider whether the insurance isCheck carefully what kind of treatment is applicable.For example, if the medical insurance policy you tried to purchase covers only certain diseases and certain advanced medical treatments, or if the differential bed charge is paid from the fifth day of hospitalization, it will be worthless if it does not pay in the event of an actual insurance accident.

If you purchase expensive medical insurance at a young age and continue to pay high premiums, you may be able to pay for advanced medical expenses and private beds that are not covered by health insurance at your own expense if you can create sufficient funds in the future by investing the money in savings.

Know when and how to review your insurance.

When there is an excess or deficiency in death benefits, it is necessary to review the insurance policy. Many people have purchased insurance as recommended by insurance agents or friends when they became company employees and have continued to pay premiums without giving it much thought. Here, we will introduce the timing when a review is necessary and the method of review.

Let's take a hard look at your insurance over/under coverage.

Now that you have an idea of the amount of coverage you need, the next step is to compare h with the amount of coverage you currently have. Many people do not know what insurance coverage they have.

Those whose current coverage is significantly less than the required coverage amount may find themselves in a situation where they are unable to ensure sufficient coverage for their surviving family members to live in the event of an emergency, so they should consider a review to increase their coverage as soon as possible.

Conversely, people who have too much coverage also need to consider this. The more coverage you have, the more secure you may feel, but you are paying more in premiums than you need. By reviewing your coverage to restore it to an appropriate level and putting the reduced premiums into savings or investments, you may be able to obtain more security for your future than you can with insurance.

When should I review my insurance?

Insurance is not a once and done deal. Review your insurance policy at the time of major life events. Specifically, the following turning points in your life are good times to review your insurance policy.

As your housing cost burden changes or the number of family members increases or decreases, the amount of required coverage will also change. At such times, it is advisable to reconfirm whether there is an excess or deficiency in insurance coverage.

Death benefit about the death benefit (funeral expenses, etc.) and minimum coverage

In many cases, when the company you work for changes, the health insurance association you join will change. Depending on the health insurance association, the co-payment amount may be different, or the burden of high medical care costs may be reduced. Review whether your current medical insurance is required by the new company.

Review single coverage and consider coverage for the couple for each other.

If group credit life insurance is purchased, consider reducing the death benefit.

Consider adding child care and education expenses for children and death benefits for the head of household

Consider reducing children's education funds and death benefits for the head of household

How do you review your insurance?

The amount of insurance coverage can essentially be increased or decreased. If there is too much coverage, the excess can be reduced from the current amount of insurance coverage. If you do not have enough coverage, the quickest way is to increase the amount of coverage in your current policy, but if the premium burden is too high, you may be able to purchase a new insurance policy with a low premium rate.

If you want to reduce premiums, you can also cancel your current insurance policy and re-purchase a policy with less expensive premiums, or cancel unnecessary riders.

What should I be aware of when reviewing my insurance?

What you want to be careful of is when you cancel your current policy and re-purchase a new one.

When cancelling a savings policy, the surrender value may be less than the premiums paid, depending on when the policy is cancelled, and this should be taken into account when considering whether to cancel.It is also important to remember that your current health status may preclude you from purchasing new insurance. If you decide to cancel your existing insurance as a result of the review, be sure to wait until after your new insurance coverage has started before you cancel.

Keep insurance and savings separate.

People often purchase savings insurance thinking that they can also save and invest for peace of mind. Specifically, "foreign currency insurance" is a good example.

While insurance is important as a life security in the event of an emergency, when viewed in terms of savings and investment, it is at an overwhelming disadvantage when compared to general savings and investment.

As explained above, the surrender value of individual annuities and whole life insurance policies can be significantly less than the premiums paid, depending on the timing of cancellation, and foreign currency denominated products can significantly damage the principal due to the impact of foreign exchange rates. Of course, investments are equally risky,Insurance products have by far the lowest return for the risk. This is not surprising, since insurance comes with a guarantee in case of emergency.

It is more economically rational to take out a low-discount insurance policy and use the premiums to save or invest.

Ensure that the amount of coverage is appropriate, as neither too much nor too little is good.

Review your insurance when you have a major life event.

When reviewing your insurance, it is not advisable to consult your current insurance company. In many cases, insurance companies will recommend policies that are more profitable for them.

Think carefully about whether you really need medical insurance.

Keep insurance and savings separate.

summary

How was it?

In this issue, we have explained the various types of insurance.

Japan is said to be an "insurance powerhouse.

Despite a well-developed universal health insurance system and a public insurance system that is more comprehensive than in other countries, the life insurance household participation rate is approximately 80% (according to the Life Insurance Cultural Center), with 2-3 policies per person, which is outstandingly high compared to 60% in the United States, 50% in Germany, and 40% in the United Kingdom. The ratio is high compared to 60% in the U.S., 50% in Germany, and 40% in the U.K.

Many of our consultants also mistakenly believe that insurance is a no-risk savings plan with no loss of principal. Savings-type insurance products have an overwhelmingly lower interest rate than savings or investments for the same period of time because of the "insurance function" added to protect against illness or injury, and in the event of cancellation before maturity, the principal is lost. In other words, you are taking the "risk" of not being able to withdraw your money for a certain period of time. If you take the same risk, you will get a higher return if you purchase a low amount of insurance as insurance and invest in low-risk investments such as government bonds. Therefore, it is not advisable to "confuse insurance with savings or investment.

On the other hand, insurance is a very important means of supporting your life in the event that something should happen to you or your family. By wisely utilizing both public and private insurance programs as a "fallback plan," you will be able to live a life with peace of mind.

At our office, "financial planners who do not sell insurance products" are available for insurance consultation.

Comments