Is investing gambling?" is a question that many people, from beginners to experienced investors, have considered at least once. Many people mistakenly view investment as gambling and shy away from it. Certainly, investments involve risk and sometimes unpredictable factors, so you may feel that they have aspects similar to gambling. However,Investment and gambling (referred to as speculation in this article) are fundamentally different in nature.This article details the differences, the nature of the investment, and the five key factors for success in investing.

If you understand why your assets will grow by investing, you will be able to grow your assets slowly and not panic in the face of a crash that may come one day.

People who should read this article

People who are afraid to invest because it's a gamble.

People who don't understand how investing can be profitable.

People who want to know what makes a successful investment.

Conclusion.

Investing is not gambling. There is a difference between investment and speculation.

As the world's population grows, the economy grows.

Assets will grow over the long term if wrong actions are avoided

The difference between investment and speculation

Both investment and speculation aim to increase assets, but there are significant differences in approach, risk, and time horizon.

Objective.

- investment: We seek long-term asset growth and expect the value of stocks, real estate, and bonds to increase over time.Investors look for stable returns in anticipation of company or project growth.

- speculation: The goal is to profit from price fluctuations over a short period of time.Risks are also higher because they anticipate short-term price fluctuations and aim for sudden gains.

risk

- investment: Although there are risks, we make decisions based on the growth of the company and the stability of the market as a whole,The risk is often relatively low.Risk diversification is also possible over the long term.

- speculation: Aiming for high risk/high return.Easily influenced by market and temporary factors that are difficult to predictWhile there are opportunities for large profits, there is also the possibility of large losses.

time axis

- investment: It is common to take a long-term view.We watch your assets grow and accumulate steady profits over several years to decades.

- speculation: Aiming for short-term profitThe transactions are mainly for short periods of time, a few hours, days, or even weeks.

technique

- investment: We purchase valuable assets based on a careful analysis of fundamentals (fundamental economic conditions), such as corporate performance and market trends.

- speculation: They seek to profit from rapidly changing price waves based on technical analysis or temporary trends in the market.

Conclusion.

Investment is a means of increasing assets with a view to long-term growth and with limited risk, whereas speculation focuses on short-term price fluctuations and is a risk-taking technique that aims for quick profits.Since they have different objectives and risk tolerance, it is important to choose the approach that fits your own asset management policy.

Why are investments so profitable?

Investments are profitable because the world's economies grow over time, and the value of countries and companies increase with that growth.We invest our own assets in the growth of the global economy and benefit from the increased value of the country and its companies.

The World EconomyGrowth and Profit Sharing

As the global economy grows, companies make profits through their business activities, and a portion of these profits are distributed to shareholders as dividends (income gain). This is the basis of stock investment. Then, as the value of the company increases, the market capitalization of the company rises, causing the stock price to rise, and the company makes a profit by selling its shares (capital gain).

So why do we say the global economy will grow?

Economic expansion is driven by population growth, new technologies and markets, and people's increased spending power.

As we have also seen in Japan in recent years, inflation (rising prices) is one of the consequences of economic growth. While inflation reduces the value of cash, it also causes corporate profits to rise, wages to rise, and the value of real assets, stocks, and real estate to rise.

Why is the global economy growing? Here is a simple analogy.

- People who walked barefoot had painful feet and made sandals.

- People who used to walk in sandals made shoes to run faster.

- I built my bicycle to get to my destination faster and easier.

- We built automobiles to get to our destinations more quickly and easily.

- We built airplanes to go faster and farther.

- We built a spaceship to go farther.

I am sorry to say that this is a very simple analogy, but people believe that "tomorrow will be better than today! We believe that tomorrow will be better than today, and we are constantly challenging ourselves to make things more convenient, easier, and more convenient. We are always challenging ourselves to make things more convenient, easier, and better.

Who could have predicted a few years ago that everyone would be walking outside on the phone or shopping online on the train to work? People's insatiable desire evolves our daily lives, and new technologies and products enrich people's lives and improve corporate profits.

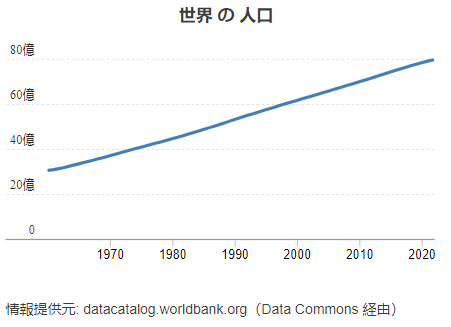

World Population Growth and Profit Sharing

According to the "World Population Projections 2024: Summary of Results" released on July 11, 2024, the world population is expected to increase over the next 60 years, peaking at 10.3 billion in the mid-2080s, up from 8.2 billion in 2024. Thereafter, it is estimated to reach 10.2 billion by the end of the century.

While Japan is suffering from a declining population due to a falling birthrate and aging population, the world's population will continue to grow and GDP (Gross National Product) per capita will continue to rise. In other wordsBy investing in growing global markets, your assets will grow with them.

Interest and yields

When you invest in assets such as bonds or deposits, you receive interest on the loaned funds. This is,It is a "reward" for money lent and a means of increasing assets over time.Stock and real estate investments may also produce dividends and rental income that provide a regular source of income.

risk premium

Investing involves risk, but the reward for that risk is a higher return than a less risky asset (such as a savings account). Investors,Instead of taking risks, you can enjoy its returns, which may increase your assets in the long run.

This "risk premium" is not limited to stocks and other securities. Even though time deposits and savings-type insurance policies do not carry the risk of loss of principal, they do carry the risk of "not being able to spend the money immediately" for a certain period of time, and the risk of a decrease in real value due to inflation.

Furthermore, asset management such as stock investment is considered to be "unearned income," but this is never the case, and "tomorrow your assets could be cut in half.We can say that we are getting a profit as "compensation" for taking a risk.

The principle of "No Pain, No Gain" is often used, especially in the context of sports and fitness, but it is also an important concept that applies to the fields of investment and business. The phrase is,That "benefit" (achievement and growth) cannot be obtained without "pain" (effort and sacrifice).In meaning, it represents the teaching that risk, difficulty, and hard work are necessary to pursue success and profit.

No Pain, No Gain" in Investments

In the investment world, this shows that it is difficult to earn high returns without taking risks. In other words, you must be prepared to accept a certain level of risk and instability in order to expect higher profits.

Specific points

Risk-Return Relationship

There is a basic concept in investing that risk and return are proportional. While safe, low-risk assets (e.g., government bonds, deposits) are stable, they also tend to have low returns. On the other hand, riskier assets, such as stocks and emerging market investments, have a higher risk of short-term losses, but may provide greater returns in the long run. To achieve large gains, one must endure the "pain" of risk.

Long-term perspective

If you withdraw from the market for fear of short-term market fluctuations or temporary losses, you may miss out on significant gains. The key to success is to remain patient and continue investing, as the market will repeatedly go up and down. This process of "enduring" is "pain," but in the long run it will lead to "profit.

Learning and Experience

Investing requires knowledge and experience. To be successful, you must continue to learn from your mistakes through trial and error. You may incur losses on your first investment, but they are "pains" for growth and lessons for future gains.

The principle of "no pain, no gain" is an important concept in investment as well. If you do nothing for fear of risk, though, you will not gain much,Proper management of risk and continued hard work and perseverance over the long term increases the likelihood of eventual rewards. The universal lesson is that only through hard work and sacrifice can success and growth be achieved.

Long-term asset growth

Investments have a "compounding" effect over time. By reinvesting the profits earned, you can achieve "snowball" growth, where your principal and profits continue to increase together. By holding for a long period of time, you increase your chances of achieving significant asset growth while diversifying your risk.

Five key factors for success in investing

There are several key points to success in investing. The major points are summarized below.

1. Take the long view

It is important to invest with a long-term perspective and not be distracted by short-term market fluctuations. The stock market and real estate, for example, may decline significantly in the short term, from one to five years, but they tend to grow over a longer period of time, so time can be your friend.

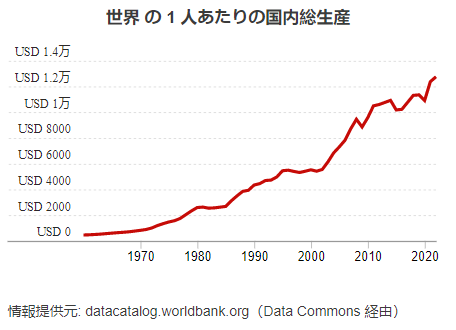

The chart below is from the famous investment book "Random Walkers on Wall Street".

Whenever you start investing in the 67 years from 1950 to 2017.

- If the investment was made for only one year somewhere, the return was a large blip from negative 371 TP3T to positive 52.61 TP3T

- The longer the investment period (5 or 10 years), the smaller the probability of a negative return.

- If the investment lasted for more than 15 years, it was never negative over any period of time taken.

- The longer the investment period, the higher the minimum return.

This means that no matter where you start your investment, if you continue to invest for 15 years or more, the chances of the outcome being negative are close to zero.

Of course, past results do not determine the future, so losses may occur depending on the timing of the investment.

(By the author Source: Random Walker on Wall Street)

2. diversified investment

It is important to diversify your portfolio to avoid the risk of concentrating in one stock or asset class. Investing in different assets, such as stocks, bonds, real estate, gold, and crypto assets, can help diversify risk.

The following information was borrowed from Sumitomo Mitsui Banking Corporation.

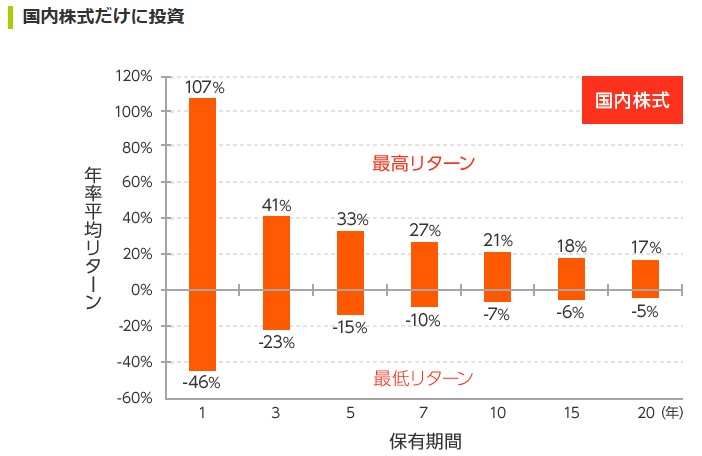

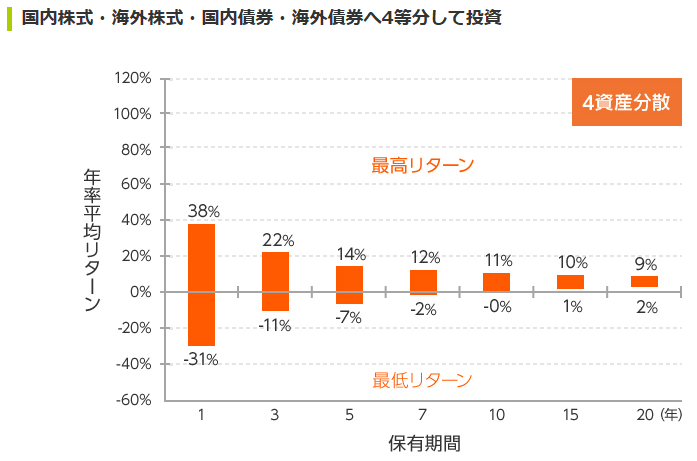

Here is the chart for "Highest and Lowest Average Annualized Returns by Holding Period (January 1970 - June 2015)."

Here is a comparison between investing only in Japanese domestic stocks and investing equally in four assets.

(in Japanese history)SMBC How to deal with risk, Part 4)

Since the period represented by this chart is just before and after the bubble burst,The "dark days of domestic equities" are strongly reflectedAs a result, the performance of domestic equities has been quite challenging.

Even in these historically difficult times, we can see that if you take a portfolio (asset allocation) that combines bonds, the likelihood of a negative return in 10 years is infinitesimally small.

3. risk management

Investing always involves risk. It is important to understand the range of risk you are willing to accept and to invest accordingly.Set an amount of money that you can withstand in the event of a loss and manage your risk appropriately.

For example, it is important to determine one's risk tolerance in advance and approach investment by saying, "I can handle a loss of 100,000 yen," "I can tolerate a loss of up to 500,000 yen," or "I can manage a fall of 10%," and so on.

Risk tolerance also generally increases with investment experience and learning.

As you become accustomed to the movements of stock prices after experiencing a few drops and rises, and as you learn more and more about the various economic mechanisms, you will be able to grow your assets over the long term, even if a crash comes.

4. Unaffected by EmotionsContinuous learning for

It is easy to make emotional decisions when markets plummet or soar. It is important to maintain calm judgment and not be influenced by fear or desire. Try to act based on the strategy you have decided upon and avoid impulsive buying and selling.

Continuous learning is essential to prevent impulsive or unnerving trading. Market and economic conditions are constantly changing. Continuing to learn new investment techniques and market trends will help you make better investment decisions. Use books and news to update your knowledge.

5. Consider fees and taxes.

Investment returns can be cut by fees and taxes. Choose financial products with low fees and take advantage of tax benefits such as NISA and iDeCo (in Japan).

By keeping these points in mind and investing strategically, you can increase your chances of success.

summary

How was it?

Investing is not the same as speculation (gambling), but is backed by the growth of the global economy and corporate value, based on people's insatiable desire that "tomorrow will surely be better than today.

On the other hand, in the short term, however, geopolitical risks such as wars, infectious diseases, financial crises, and other factors beyond our ability to predict or control can often cause a crash. The important thing is to understand the risks, not to be overly fearful, to find an investment approach that suits your style, and to continue to invest without hesitation. A solid plan, risk management, and continuous study are important.

Comments