It is becoming more serious all over Japan.unoccupied house problemare having a negative impact on local economies, disaster prevention, and public safety due to the declining birthrate, aging population, and concentration of population in urban areas. The increasing number of vacant houses not only reduces their value as assets, but in some cases, unmanaged houses become dilapidated, at risk of collapse, and become breeding grounds for crime. Local and national governments are taking measures such as tax incentives and subsidies for demolition costs, but fundamental solutions have yet to be found. In this article, an administrative scrivener qualified as a real estate agent explores the current status of the vacant house problem and possible solutions.

People who should read this article

People who are having trouble disposing of their family home acquired through inheritance.

People who want to know what the vacant house problem is.

A person whose mother lives alone at home but does not plan to return herself.

People who have aging parents and want to start thinking about inheritance planning.

What is the vacant house problem?

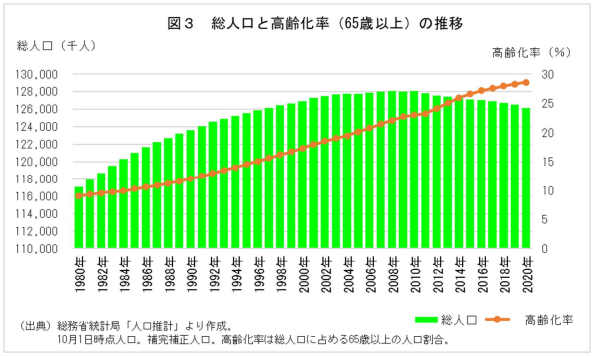

The vacant house problem refers to the increase in the number of unused houses and buildings and the various social, economic, and environmental challenges that result. In particular.With Japan's declining birthrate, aging population, and shrinking population, the number of vacant houses is increasing in both rural and urban areas, and this is becoming a serious problem.

Main Issues

- Security and disaster prevention risksThe danger is that vacant houses are often poorly managed and can become a breeding ground for arson, trespassing, and crime. Dilapidated buildings may also be at risk of collapse.

- Deterioration of the landscapeThe following is a list of the most common reasons why vacant houses are neglected: Abandoned houses can spoil the local landscape and have a negative impact on the living environment of the surrounding residents.

- Decline in land prices: As the number of vacant houses increases, property values in the area may decrease and land prices may fall.

- economic loss: Vacant houses cause economic losses as their value as assets decreases due to ineffective use of the land and buildings. In addition, the cost of maintaining and removing vacant homes is costly, which places a burden on the owner.

- Tax Issues:Even vacant houses are subject to property taxes.Therefore, while this is a maintenance burden for owners, there are some areas where tax revenues are reduced.

(Source:Government Public Relations Online)

Background of the vacant house problem in Japan

- Declining and Aging PopulationIn many regional cities in Japan, the demand for housing is decreasing due to population decline, and the number of vacant houses is increasing. In addition, elderly people are giving up their homes due to death or moving into institutions,If the heirs do not use the house, it will also become vacant.

- Concentration in cities: The number of vacant houses in rural areas is increasing as many young people move to urban areas. Also,As new condominiums and homes continue to be built in urban areas, older homes in rural areas may be abandoned.In other words, many people leave their parents to live away from home when they go to college, get a family after graduation, and buy a house, and in many cases do not return to their parents' home after their parents' death.

- Inheritance Issues: When a parent dies, the house is inherited by children or relatives, but if the heirs do not use the house, it becomes vacant. This is especially the case when heirs living in urban areas own real estate in rural areas,They become difficult to care for and manage and are often neglected. Often it is also difficult to sell due to inheritance taxes and maintenance costs.

- Decline in market value of real estate: The value of real estate is declining, especially in some rural areas,Some areas are difficult to sell or rent. As a result, more and more homes are left unsold, resulting in vacant homes.Even in urban areas, older homes are difficult to sell and may become vacant.

- Cost of maintenance and management: Maintaining and managing a vacant house can be expensive. House repairs and property taxes are a burden,Owners may lose the incentive to actively manage the property.As a result, more and more are left unattended and unoccupied.

- Excess housing supplyHousing supply in Japan increased significantly during the postwar period of rapid economic growth and the bubble economy. This was the result of a rush to construct housing, especially after the bubble period,Today, the housing supply is excessive and exceeds demand. As a result, an increasing number of excess housing units are becoming vacant.

- Legal and regulatory constraintsIn Japan,In some cases, the cost of demolishing old homes and building code regulations make it difficult to rehabilitate them.These regulations may cause vacant houses to be left unoccupied. Also,The tax burden of selling an inherited home is another factor that causes owners to continue to hold on to and neglect vacant homes.

Facts about vacant houses

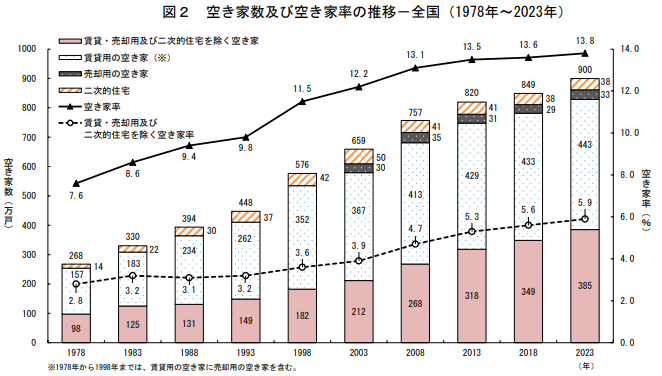

According to a survey conducted by the Ministry of Internal Affairs and Communications on May 4, 2024, the number of vacant houses nationwide reached 9 million, or 13.81 TP3T of the total number of houses, the largest number ever recorded. The number of vacant houses has continued to increase in various regions against the backdrop of a declining and aging population, doubling the number from 1993, 30 years ago, and accounting for 13.8% of all housing units, the highest percentage ever recorded.

By prefecture, Tokyo had the largest number of housing units at 898,000, followed by Osaka with 703,000, Kanagawa with 466,000, and so on. 40 prefectures showed an increase from the previous survey. (NHK News)

Total area of vacant lots and houses equals the area of KyushuThe situation cannot be overlooked in Japan, a country with a small land area.

(Source:Results of the 2023 Housing and Land Survey (Statistics Bureau, Ministry of Internal Affairs and Communications)(Used on September 21, 2024)

Measures against vacant houses (legal system)

If vacant houses are left unattended, they will have a negative impact on the surrounding area in terms of hygiene and crime prevention, such as rats, vermin, and trespassing, in addition to collapsing and safety issues. This problem also needs to be solved as soon as possible in order to make effective use of limited land.

Vacant House Law (amended in 2023)

The Vacant House Law (Law on Special Measures Concerning the Promotion of Measures to Cope with Empty Houses) was enacted in 2014 to solve the problem of vacant houses.

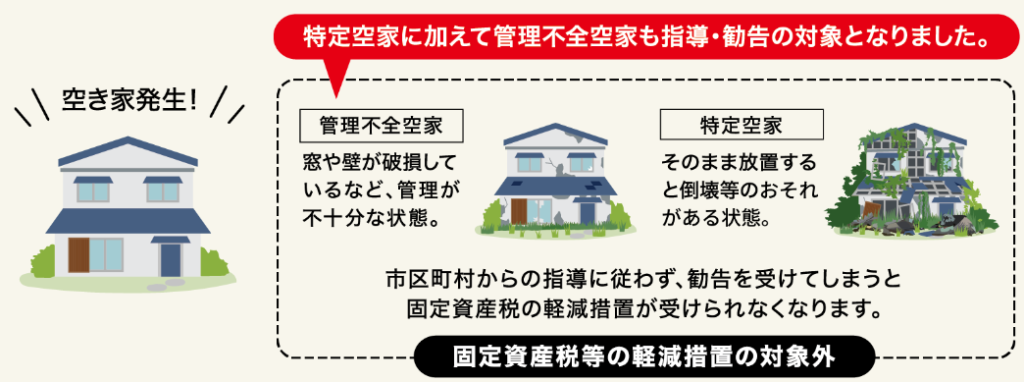

Under this law, municipalities designate vacant houses that pose a high risk of collapse or otherwise have a significant negative impact on their surroundings as "specified vacant houses" and provide advice and guidance on how to properly manage them. If the owner does not comply with the order, he or she may be subject to a fine of up to 500,000 yen, and the government may take action such as forcible removal of the property.

In 2023, the Vacant House Law was revised to further promote the utilization and management of vacant houses, and vacant houses in the "specified vacant house reserve" category that are not properly managed are now subject to guidance to their owners as "unmanaged vacant houses.

However, if a house is not subject to the guidance for "unmanaged vacant houses" or "specified vacant houses" and receives a recommendation, the tax burden reduction measure (residential land use exception) will no longer be available.

Obligation to register inheritance

Until now, there have been many cases where a home was acquired by inheritance but left unregistered due to reasons such as "I don't plan to live in it," "It is worthless and cannot be sold even if I dispose of it," "It is costly to tear it down," and "I am burdened with taxes such as fixed property tax.

Vacant houses left unregistered for decades, and then neglected for generations, make it difficult for the government to deal with them because it is no longer clear who the true owner is. The Civil Code guarantees the absolute principle of "ownership," and the government could not dispose of the property without permission.

Against this background, the application for inheritance registration became obligatory as of April 1, 2024. A summary of the changes is as follows.

- Inheritance (including wills) An heir who acquires real property byAn application for registration of inheritance must be filed within three years of the date of knowledge of the acquisition of ownership.

- In the event of a division of the estate, the heirs who acquired the property as a result of the division,The inheritance must be registered within three years from the date the division of the estate is finalized.

- If you violate your obligations without just cause (*) for either (1) or (2), you mustSubject to a fine (administrative penalty) of up to 100,000 yen.

- In addition,In the case of inheritances that began before April 1, 2024, they will also be subject to the mandatory requirements, although there will be a grace period of three years.

principle of absolute ownershipis the basic legal principle that the owner has the right to freely use, profit from, and dispose of his property (real or personal). This means that the owner has complete control over the property without interference from others. This principle is fundamental to the protection of private property rightsand is especially important in civil law and real estate law.

Characteristics of the principle of absolute ownership

- freedom of use:The owner is free to decide how to use the property.For example, you are free to use your home as a residence, rent it out or sell it.

- Profit Freedom:The owner is entitled to the benefits derived from the property as his or her own.For example, if you own land, all rents and revenues generated from it belong to the owner.

- freedom of disposal:The owner may transfer, gift, or dispose of the property to others.This is also done at the owner's free will.

Limitations on the principle of absolute ownership

In the modern legal system, however, the principle of absolute ownership does not apply without limitation. Owner's rights may be limited in the following cases

- public interest (e.g. public good): Ownership may be restricted when the owner's property is involved in the public interest, for example, when the land is needed for urban planning or infrastructure development. This includes, for example, compulsory expropriation of land.

- Coordination with the rights of others: There are restrictions on exercising ownership rights that prohibit infringing on the rights of adjacent landowners or third parties. For example, illegal use of another person's land or making excessive noise are restricted.

- Regulation by lawThe owner's freedom of action may be restricted by legal restrictions, such as: building codes and environmental protection laws. For example, permits or restrictions may be imposed on development or construction on a particular site.

Relationship with Public Welfare and the Meaning of Absolute Ownership in Modern Times

The principle of absolute ownership is,While it is an important concept for protecting individual property rights, the emphasis is on balancing the public interest and the rights of others.Therefore, although ownership is only an "absolute right," it requires respect for social responsibilities and the rights of others.

Special provisions when selling a decedent's residential property (vacant house)

If an individual who has acquired by inheritance a property that was the decedent's residence or its site immediately prior to the commencement of inheritance transfers it, a special deduction of 30 million yen from the transfer income of the residential property can be applied to the amount of the transfer income.

(As of September 2024, applicable to transfers from April 1, 2016 to December 31, 2027)

Eligible assets

- Houses built before May 31, 1981 (excluding condominiums and other buildings with condominium units)

- The building must have been used for the decedent's residence immediately prior to the commencement of inheritance, and the decedent must have lived alone (buildings that became vacant after the decedent entered a nursing home immediately prior to the commencement of inheritance are also eligible for application).

- The house or site has never been used for business, rental, or residential purposes from the time of inheritance to the time of transfer.

Terms and Conditions of Transfer

- The transfer must be made between the time of inheritance and December 31 of the year that includes the date three years after the date of commencement of inheritance (transfer deadline).

- Only when the total consideration for the transfer from the start of inheritance to the transfer deadline is 100 million yen or less

- (i.e., those that meet certain earthquake resistance standards at the time of transfer after earthquake-resistant renovation, etc., or after demolition of a residential house and transfer of the site of the house.

special deduction

A special deduction of 30 million yen per person is available for the transfer of the decedent's residential house and its site owned jointly by multiple heirs, etc., if the above requirements are met. However, for transfers after January 2024, if the number of heirs who acquired the property is three or more, the deduction is 20 million yen per person.

Duplicate application of special provisions

Special provisions for taxation of transfer income on inherited property (addition to acquisition cost for inheritance tax purposes) may be applied at the option of the taxpayer. However, it is possible to apply the special provisions for the replacement of property used for one's own residence and the 30 million yen special deduction for property used for one's own residence in the same year. (If the 30 million yen deduction for personal residence property is applied in the same year, the total amount of the special deduction is limited to 30 million yen.

filing requirement

A "Certificate of Confirmation of Decedent's Residential House, etc." and other documents must be attached to the tax return by the head of local government, etc.

Vacant house measures (other)

vacant house bank system

What is the "Vacant House Bank"?This system allows local governments to consolidate information on vacant houses and introduce them to prospective immigrants and local residents.This system matches owners of vacant houses with those who wish to use them, thereby promoting the effective use of vacant houses. Many local governments offer subsidies and tax incentives for the rental or purchase of vacant houses to increase the number of immigrants.

Support for renovation of vacant houses

With the aging of vacant houses becoming an issue, renovation is being promoted to reuse them.Governments and municipalities are promoting the renovation of vacant homes by offering subsidies and low-interest loans for renovations.The renovated houses will be converted into rental housing, shared housing, commercial space, community facilities, etc., contributing to the revitalization of the community.

Conversion of vacant houses to other uses

Converting vacant houses to other uses, not only as residences, is also an effective measure.For example, an increasing number of vacant houses are being reused as cafes, restaurants, lodging facilities, ateliers, and coworking spaces. In addition, the use of vacant houses as local exchange centers and community centers is also expected to strengthen the ties between local communities.

Migration Promotion and Settlement Support

Many local governments have developed policies to promote immigration and settlement by utilizing vacant houses. For example,There are programs that offer vacant houses to the young and child-rearing generation at low prices and subsidize renovation costs.These measures promote migration to rural areas and contribute to curbing population decline and revitalizing local communities.

Community-driven utilization of vacant houses

There is also a movement to promote projects to utilize vacant houses led by local residents, NPOs, and private companies.This allows for utilization according to local needs. For example, there are cases where vacant houses are reused as local specialty shops or direct sales centers for agricultural products.

Collaboration with the private sector

Increasingly, private companies are collaborating to manage and reutilize vacant houses.For example, efficient use of vacant houses is being promoted in cooperation with companies engaged in renovation projects and management of vacant houses.

summary

How was it?

The issue of vacant houses is an important challenge for building a sustainable society and requires different responses in each region.

In addition, vacant house management is an issue for the entire community, and it is important that owners, government, businesses, and communities work together to address this issue. Various approaches are needed according to the characteristics of each community, and the vacant house problem is being solved from a long-term perspective.

It is important that you and your family discuss the disposition of your current home, your parents' home, and, if necessary, consult with the government and experts to determine a solution as soon as possible.

Comments